Table of Contents

About Trailing Stop Sell

A Trailing Stop Sell order sets the initial stop price at a fixed percentage below the market price as defined by the Trailing Amount. As the market price rises, the sell stop price rises one-to-one with the market but always at the interval set initially by the trailing percentage amount. If the stock price falls, the stop price remains the same. When the stop price is hit, a market order is submitted. Reverse this for a buy Trailing Stop Sell order. This strategy may allow an investor to limit the maximum possible loss without limiting possible gain.

Steps to place a trailing stop sell order

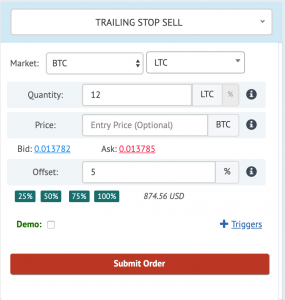

- Select Trailing Stop Sell order type

- Select Base and Quote coin.

- E.g. Market: BTC/LTC

- Select the number of coins needs to be sold. You can also select percentage option to specify relative coin volume.

- E.g. 10 coins. (quantity could be in the fraction)

- Or 20% of quote coin.

- Enter the quote coin price at with you bought. If is left blank, current market bid price will be used.

- E.g. 0.01516 BTC

- The offset is fixed percentage value below the market price. Using this a stop loss order is placed with an offset of x% from the peak market. If the market will go up, stop loss value will go up. If the market comes down stop loss will not change.

- E.g. Offset = 3%

Note: At the beginning, the peak value is Max between Buy price or Current Market price.

A hypothetical example

Assume a Trailing Stop sell is placed for 1 LTC with 5% offset when beginning peak price is $100.

|

No. |

LTC price per 1 unit |

Trailing Stop value |

|

1. |

$100 |

$95.0 |

|

2. |

$98 (correction) |

$95.0 |

|

3. |

$101 (rise) |

$96.0 |

|

4. |

$104 (rise) |

$98.8 |

|

5. |

$106 (rise) |

$100.7 |

|

6. |

$110 (rise) |

$104.5 |

|

7. |

$108 (correction) |

$104.5 |

|

8. |

$104 (Execute SellOrder) |

$104.5 |

Compared to investing in gold or the stock market, investing in the crypto market is a different thing with different or unique strategies and rules to make profits.

We all know that the crypto sphere is a highly volatile and unpredictable market. Investing only in a single coin may increase the risk of loss. And, you know people with limited or zero knowledge about the market often make mistakes while investing in crypto. Some of these common mistakes are:

- Trusting the wrong crypto exchange platform

- Overtrading

- Trading with emotions

- Not following the latest trends in the crypto market

- Not diversifying portfolio

Choosing the right trading platform and the best crypto trading bots will let you become a much better crypto trader. Isn’t it?

So, have you ever wondered how professional crypto traders ride those big trends? Do you know any kind of trend that keeps going higher and locks your profit- while you do nothing?

Well, a great way to preserve capital or lock in your gains while trading cryptos is to use stops and trailing stops. Of course, you need a solid strategy to make the stop orders work for you and not against you!

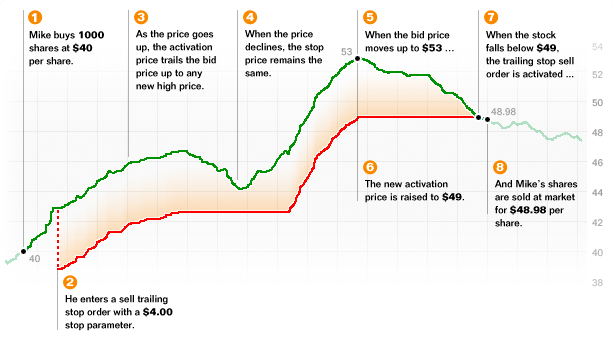

Let’s understand it with an example of setting stops with an image:

In this example, one would want to buy crypto assets towards the bottom (illustrated by the green color). Then, he would place ‘Stop” below that range. Here you will see Stop 1 and Stop 2.

Stop 1 represents a somewhat ‘tight’ stop below the current range.

Stop 2 represents ‘loose’ stop placed below a previous range. The loose stop has not stopped at all. The looser the stop more will be the risk, but it is less likely to hit.

Try reducing your position size if you are going to loosen up your stop to minimize the risks. Try moving your stops up to lock in profits as soon as you see that a new higher range is created.

And, here comes the role of Trailing Stop orders. This kind of stop moves up as the price moves up. Trailing stops are very useful and they require some set of strategies and tricks.

Trailing Stop order

For certain traders, trailing stop orders are very beneficial.

But every trader must know about them well and these orders should be a part of their strategies. You never know when they will come in useful.

Every trader wants to lock their profits and protect against losses. No one wants to see their gains reversed.

And, we at Growlonix will discuss here how Trailing stop sell and Trailing stop loss orders will work for you!

Consider it as a tool in your crypto trading strategy.

If you are entering a trade without a stop, it’s not a trade actually. Rather, you are just playing on your luck.

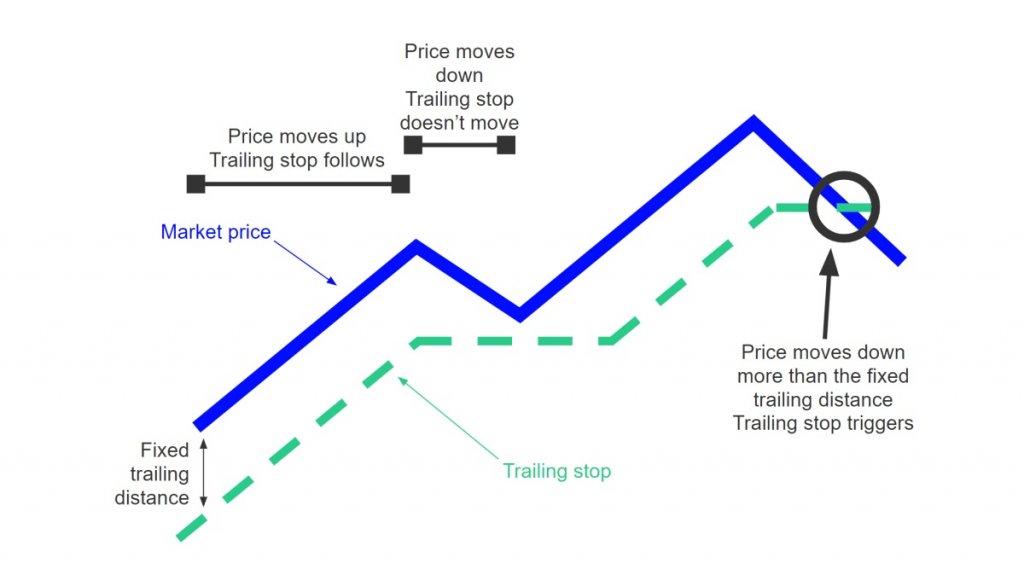

Stop market orders are also known as stop-loss orders. Trailing stop orders are the stop or stop-limit orders in which the stop price is not a specific price. As the price of security moves in a favorable direction the trailing stop price will adjust or trail the market price of the crypto asset/security by the specified amount.

And, if the price doesn’t move in a favorable direction, the trailing stop price will remain fixed, and the order will be triggered only if the price of the crypto asset reaches the trailing stop price.

Before using a trailing stop order, the trader must consider the below facts:

- Make sure to select the trailing stop price carefully which you are using for a trailing stop order since the short-term fluctuations in the market price may trigger the Trailing Stop order.

- As with stop and stop-limit orders, different trading venues may have different standards for determining whether the price for the Trailing stop order has been reached. There are some exchanges that use only the last sale prices to trigger the order, while other platforms go with the quotation prices.

Trailing stop orders are the more flexible variation of the normal exit order. Using this strategy, the stop order would follow the last traded price based on the predefined distance. And, the Trailing stop order will automatically move to lock in profit and stop loss.

How to use Trailing stops?

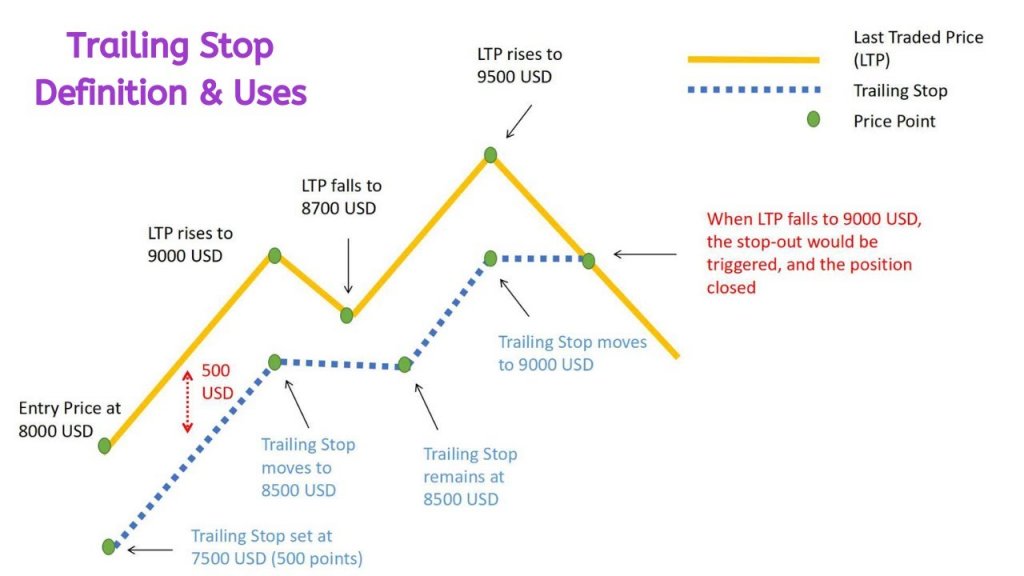

Example:

Suppose a trader is holding a long position of BTCUSD contracts at $8,000 and has set a trailing distance of $500. Once the last traded price goes up, the Trailing Stop will move up and maintain the trailing distance of $500.

For example, if the last traded price moves up to 8,600 USD, the Trailing Stop Price will automatically be adjusted to $8,100 to lock in the profit. This means that the Stop Loss will trigger only if the price drops by $500 from the highest price reached. However, if the price never went up the Trailing Stop will be triggered a $7,500 just like a normal Stop Loss.

Trailing stops provide efficient ways to manage risks and traders use them as a part of their exit strategy. If a trailing stop loss of 10% is added to a long position, the sell order will be executed if the price drops 10% from the peak price after the purchase.

Another example for Trailing Stop

To better understand how Trailing stop works, consider a crypto asset with the following data:

- Buying price $10

- Last price at the time of setting Trailing Stop $10.05

- Trading amount 20 cents

- Immediate effective stop loss value$9.85

If the current market price moves to $10.97, your trailing stop value will rise to $10.77. And, if the last price drops to $10.90, your stop value will remain the same i.e. $10.77. if the price continues to drop and reaches $10.76, it will automatically penetrate the stop-level, and trigger a market order immediately.

So, the order is submitted based on the last price of $10.76. Assuming that the bid price was $10.75 at that time, the position would be closed there and the net gain in this trading would be $0.75 per share and less commissions.

During the price dips, it is a must to resist the impulse to reset trailing stops, or else your stop loss may end up lower than expected. By the same token, reining in Trailing Stop Loss is advisable when you see continuous peaking in the charts, especially when the asset price is hitting a new high.

Using the Trailing stop and stop-loss combo is recommended on the active trades

Trailing stops are more difficult to use with active trades, due to volatility and price fluctuations in the crypto market, especially during the first hour of the day. Such fast-moving stocks usually attract traders, because of their potential to generate a substantial amount of money in such a shorter period. Using this combo is beneficial for active trades and lets you lock in your profits.

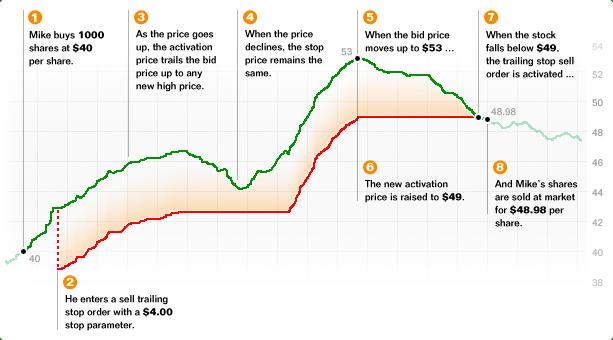

Let’s understand it with the following stock example:

- Buying price $90.13

- Number of shares= 600

- Stop-loss $89.70

- First trailing stop = $0.49

- Second trailing stop =$0.40

- Third trailing stop =$0.25

Here, our sample stock is Stock Z which was purchased at $90.13 with a stop-loss at $89.70, and an initial trailing stop of $0.49 cents. When the last price reaches $90.21, the stop-loss was canceled, as the trailing stop took over. If the last price reaches at $90.54, the trailing stop was tightened to $0.40, with the intent of securing the trade even in the worst scenario.

As the price moves steadily towards $92, it was time to tighten the stop. When the last price reaches to $91.97 and the trailing stop was tightened to $0.25 cents from $0.40. The price now dipped to $91.48 on small profit-taking, and all your coins were sold at $91.70. Here the net profit comes as 1.74%.

Although, there are some significant risks with using Trailing stops, make sure to combine them with Trailing stop loss to minimize losses and protecting gains.

Trailing stop sell, Trailing Stop Limit, and Trailing stop loss are the advanced methods/tools used to exit your exiting positions- either long or short.

Let’s understand these one by one:

Trailing Stop Loss

Trailing Stop loss order is typically used as a closing order to limit losses or lock in your profits on a long or short position. But they can also be used to open a position.

Stop Loss: Triggers the next order type when the last market price hits the stop price. The next order can be Market Sell, Limit Sell, or Trailing Stop Sell.

A Trailing Stop-loss order ensures that you never lose under the specified amount and will decrease the risks. As the stock price rises, the stop moves higher too, locking in profit and reducing the risk of a loss.

For example, suppose you buy BTC at $100 and enter a $20 trailing stop. When the BTC price moves to $120, your stop moves to break even. When the BTC moves to $150, your trailing stop price will move to $130, and locking in $30 of profit.

A trailing stop can also be applied to a short position. Here, the stop order will move lower as the price falls. Crucially, the stop loss only moves in the direction of the trend, never back. This means the only risk of losing more than the trailing stop amount comes from slippage or an overnight gap.

A trailing stop loss order is placed just like a stop-loss order while entering a position but the key difference is that, unlike the traditional stop loss, the Trailing stop loss will follow the price as it moves up and then waif of the price moves down. The distance at which the Trailing Stop loss order follows the price can be determined as the trailing percentage.

How to place Stop Loss Limit at Trailing Crypto:

- Select Stop Loss order type.

- Select Base and Quote coin. E.g. Market: BTC/LTC

- Select the number of coins that need to be sold. E.g. 10 coins. (Quantity could be in the fraction)

- Now, click on the drop-down menu near Take Profit. It will pop up with 3 options: Market, Limit, and Trailing. Selection of an option means when market price (ask price) rises to the Stop value, the selected order in the drop-down menu will be executed (Market Sell, Limit Sell, or Trailing Sell).

- E.g if the current ask price of LTC is 0.011189 BTC.

- Stop value can be a place at 0.011000, ~2% below the current price.

- Suppose the market hit 0.011000. This will trigger subsequent orders. Below are the possibilities:

- Market Sell: A Market Sell order will be placed.

- Limit Sell: A Limit Sell order will be placed having limit value mentioned during placing the order.

- Trailing Stop Sell: A trailing Stop sell order will be placed with the mentioned offset during placing the order.

Suppose the current price of BTC is $100. Now someone placed Stop Loss with Trailing Stop Sell order, for 1 BTC with stop value $90 and Trailing offset 5%. Now when the BTC price dip to less than or equal to $90, a Trailing Stop Sell order will be placed.

Let’s say the market bounce back again and reached the peak of $116 and then start correcting. The time when the market reaches $112.5, a Market Sell order will be placed.

Another example Trailing Stop loss:

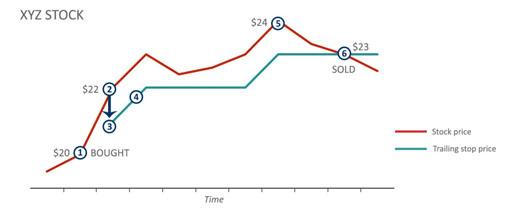

You purchase a crypto coin, say XYZ at $10 and you set trailing stop loss at 5%. If the price falls to $9.50, XYZ will be sold. But if the price increases, so do your trailing stop loss.

- If the price rises to %14, the trailing stop-loss order will now sit at $13.30.

- If the coin price for XYZ reaches $20, your trailing stop loss will be at $19.

Trailing Stop Limit Orders

If you want to benefit as your crypto asset price moves higher and you are willing to wait for your gain, but you think it’s unlikely to happen immediately.

While you are waiting, the prices are moving up and down. We all know, no stock moves up straight and this is a normal part of the volatile crypto market. It could be painful to see the gains evaporate or even it may turn into your loss. And here comes the other type of order which would give you some control to sell or buy an order- the Trailing stop limit order.

How does a trailing stop limit order works?

This order type will allow you to set a trigger delta, which is how much the price for any crypto asset could fall before you want to sell an order or rise before you would want to buy. You can specify this as a percentage amount.

Once you set the trigger delta, Growlonix recalculates the price that will trigger your order based on the current market price of the crypto asset as it moves in a favorable direction i.e. rising for a sell order and falling for a buy order.

Your sell order will be triggered as the limit order. You determine the limit price by specifying how far from the trigger price you will allow the selling of your crypto asset.

Situation 1

Price moves down:

Step 1- The sell trigger

- A crypto asset is trading at $80.00 and you choose a 5% trigger delta.

- Your sell order will be triggered if the market price falls to $76.00 ($80.00 – 5% = $76.00)

Step 2 — Sale at a limit price

- Your sell order is triggered at $76.00 and you choose a $1.00 limit offset

- The limit price for your sell order is $75.00 ($76.00 – $1.00 = $75.00)

Situation 2

Price moves up:

Step 1 – The sell trigger

- The stock price reaches to $95.00 and you choose 5% trigger delta.

- Your sell order is triggered if the market price falls to $90.25 ($95.00 – 5% = $90.25)

- Step 2 — Sale at a limit price

- Your sell order is triggered at $90.25 and you chose a $1.00 limit offset

- The limit price for your stock is $89.25 ($90.25 – $1.00 = $89.25)

Trailing Stop buy limit

This is a mirror image of a sell order and can be used to protect profits generated through short selling or when trying to buy any stock which is bouncing off a market low.

This is the reverse of sell order. You will look at the current market price and decide how much the price could increase before you want to buy.

- If price increases 5%, trigger buy order

- If the price increases by $5, trigger buy.

Trailing Stop sell

A Trailing Stop Sell order sets the initial stop price at a fixed percentage below the market price as defined by the Trailing Amount. As the market price rises, the sell stop price rises one-to-one with the market but always at the interval set initially by the trailing percentage amount.

If the stock price falls, the stop price remains the same. When the stop price is hit, a market order is triggered. Reverse this for a buy Trailing Stop Sell order. This strategy may allow an investor to limit the maximum possible loss without limiting possible gain.

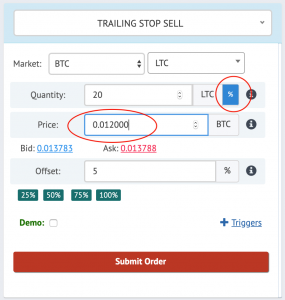

How to set Trailing Stop sell order at Growlonix?

Steps to place a trailing stop sell order

- Select Trailing Stop Sell order type

- Select Base and Quote coin.

- E.g. Market: BTC/LTC

- Select the number of coins which need to be sold. You can also select the percentage option to specify relative coin volume.

- E.g. 10 coins. (quantity could be in the fraction)

- Or 20% of quote coin.

- Enter the quote coin price at with you bought. If it is left blank, the current market bid price will be used.

- E.g. 0.01516 BTC

- The offset is a fixed percentage value below the market price. Using this, a stop loss order is placed with an offset of x% from the peak market. If the market will go up, stop loss value will go up. If the market comes down stop loss will not change.

- E.g. Offset = 3%

Hypothetical example:

Assume that a Trailing stop sell is placed for 1 BTC with 5% offset when the beginning peak price is $100.

| S. No. | BTC price per unit | Trailing stop value |

| 1 | $100 | $95 |

| 2 | $98 | $95 |

| 3 | $101 | $96 |

| 4 | $104 | $98.8 |

| 5 | $106 | $100.7 |

| 6 | $110 | $104.5 |

| 7 | $108 | $104.5 |

| 8 | $104 ( execute a sell order) | $104.5 |

Conclusion

In this guide, we have shown how trailing stop order works and are the most powerful crypto trading tools to lock in profits. Growlonix not only offer Trailing stop market or Trailing stop limit orders for different crypto exchanges, but also provides great features for trailing stop orders and allows connecting fully-automated Trailing stop loss and Trailing stop sell orders to every Trailing Stop order.

Extremely Helpful. I am so new at this and what a learning curve…Thank you guys. I am slowly finding my way.

I’ll strongly recommend to go through https://www.Growlonix.com/support/article/order-form-glossary

Typical form users give feedback that it easy to use Growlonix, and usually, they say that has a very little learning curve.

If it’s free.. Then give us the code..

I want code, not to “trust” you with my api key… Hello?

Its is not an open source project. So we regret to say we won’t be able to share our codebase.

Its not completely free. You can check pricing at the top menu in homepage. which will come into effect once Beta phase ends.

Providing the platform API access does not include giving them the ability to transfer funds from your exchange, only trade on your behalf.

WTF….. LOL

You think there is really free lunch on this world?

Make a trading key disable withdraw

I am having a hard time with this.

Using the “TAKE PROFIT – TRAILING”

ETH / TRX

0.00025371 : Profit Point set with a Offset:0.5%

0.00025626 : Current

so this is a profit of + 0.94%.. .I am assuming this is over the .5% offset however the price rose above this to like

2% and dipped down to -2.5% profit and no sell order was placed.

My thought was that the trailing limit would have triggered if it dipped to .5% profit right?

I do not understand this. I thought I did it correct.

I was trying this. I set the Traiding Stop Sell at 1% below market price with offset of 1%.

At one momnent the price went up 3% So the order also changed.

Then suddelny the price dropped down 4% but there was no sell placed. Instead it changed the order agian downwards, so if it is placed now I would lose 1%. This is not what I want. What did I do wrong.

It should have sold when price fell 1% lower than maximum reached price in your example. You must configured something wrong. Did you use uppar & lower stop from advance options? Can you tell us your order id for us to debug.

Hi Testing comments

Hi , in your hypotetical example when price falls to 104$ Execute sell order… at what price do you place the order ? ( at 104.5 ?) how much time does it take to be placed?

If price hit 104, the immediately a market order takes place on the exchange and this happens within a few milliseconds. But, there can be a max 2-sec latency between the exchange price change and reflecting that price in the Growlonix system.

I think it does not work how it should. I placed Trailing Stop Sell with offset 3% and Upper Stop at *1208, but it executes at *1014 (after fall from *1046 which is -3%). Here is screenshot

If I understand, order should by activated above price *1208, am I right?

No, your understanding of upper stop is not correct. Please go through this documentation https://www.Growlonix.com/support/article/order-form-glossary#Upper_stop