Table of Contents

What is take profit order?

Take Profit orders are used to set a target profit price on an unleveraged spot trade or a leveraged long or short position. The profit price is to be set in terms of absolute price. As with Stop orders, Take Profit orders can also be used to open positions. Take Profit Triggers the next order type when the last market price hits the stop price. Next order can be Market Sell, Limit Sell or Trailing Stop Sell.

Take Profit explanation as per Investopedia

Most traders use take-profit orders in conjunction with stop-loss orders (S/L) to manage their open positions. If the security rises to the take-profit point, the T/P order is executed and the position is closed for again. If the security falls to the stop-loss point, the S/L order is executed and the position is closed for a loss. The difference between the market price and these two points helps define the trade’s risk-to-reward ratio.

The benefit of using a take-profit order is that the trader doesn’t have to worry about manually executing a trade or second-guessing themselves. On the other hand, take-profit orders are executed at the best possible price regardless of the underlying security’s behavior. The stock could start to breakout higher, but the T/P order might execute at the very beginning of the breakout, resulting in high opportunity costs.

Take-profit orders are often placed at levels that are defined by other forms of technical analysis, including chart pattern analysis and support and resistance levels, or using money management techniques.

How to place Take Profit:

- Select Take Profit order.

- Select Base and Quote coin.

- E.g. Market: BTC/LTC

- Select the number of coins needs to be sold.

- E.g. 10 coins. (quantity could be in the fraction)

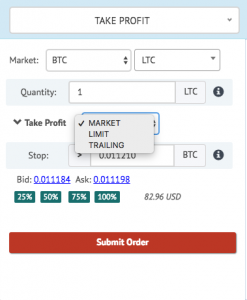

- Now, click on the drop-down menu near Take Profit. It will pop up 3 options: Market, Limit, and Trailing. Selection of an option means when market price (bid price) rises to the Stop value, the selected order in the drop-down menu will be executed (Market Sell, Limit Sell or Trailing Sell).

- E.g if the current bid price of LTC is 0.011184 BTC.

- Stop value can be a place at 0.011210, 1% above the current price.

- Suppose market hit 0.011210. This will trigger subsequent order. Below are the possibilities:

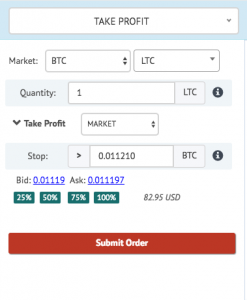

- Market Sell: A Market Sell order will be placed.

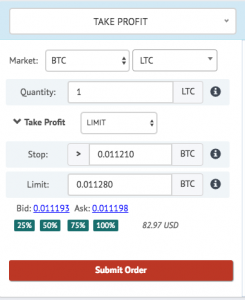

- Limit Sell: A Limit Sell order will be placed having limit value mentioned during placing the order.

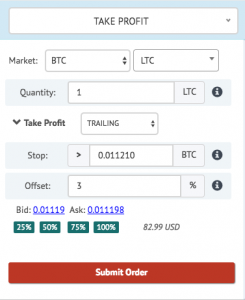

- Trailing Stop Sell: A trailing Stop sell order will be placed with the mentioned offset during placing the order.

*Note: Always make sure the Stop Value is higher than current Bid Price.

Take Profit and it’s Options

Take Profit with Limit Sell

Take Profit with Market Sell

Take Profit with Trailing Stop Loss

A hypothetical example:

- Case 1 Take Profit with Market Sell:

- Suppose the current bid price of NEO is $100. Now someone placed a Take Profit with Market Sell order, for 1 NEO coin with a stop value $110. Now when the NEO market bid price hit $110, a Market Sell order will be placed at $110.

- Case 2 Take Profit with Limit Sell:

- Suppose the current bid price of NEO is $100. Now someone placed a Take Profit with Limit Sell order, for 1 NEO coin with a stop value $110 and a Limit value $115. Now when the NEO market bid price hit $110, a Limit Sell order will be placed with limit value $115.

- Case 3 Take Profit with Trailing Stop Sell:

- Suppose the current bid price of NEO is $100. Now someone placed a Take Profit with Trailing order, for 1 NEO coin with stop value $110 and Trailing offset 3%. Now when the NEO bid price hit $110, a Trailing Stop Sell order will be placed. Let’s say market hit $120 and then start correcting. When the market bid reaches $116.4, a Market Sell order will be placed.

A quick guide

How long will the magic of the current Bitcoin market position continue? When will the next recession in Bitcoin be there? As a Bitcoin or cryptocurrency enthusiast, I hope the prices should go up. But the truth is, there will be a recession again at some point in future. The cyclical ups and downs are the reality of the cryptocurrency market, and they get magnified further with a larger speculative element.

Well, we are discussing all this to demonstrate the merits of using a disciplined strategy to build a position in the high-risk and high-return crypto assets like Bitcoin. Let’s understand it with an example:

Example

Mr. A invested a small amount in a crypto asset say, Bitcoin, in 2020 for $400. And, by the end of the year, Bitcoin reaches $900. Mr. A has now almost doubled his investment. The price dipped a few times but it always came back stronger than before. So, Mr. A invested more and saw a rise above $2000 in Bitcoin.

A few more dips came, but Mr. A had seen this before and he knew what to do. So, he invested more, and prices rose to $4000, then $6000, and finally, it reached to $10,000, and way beyond.

Mr. A continued to hold the position and waiting for a target price where he could sell his Bitcoin. One day, Bitcoin hit a peak above $17000 and now it started crashing. The problem with peaks is that we only see them in distant observation. Initially, it looked like a dip. It fell to $10,000 and then rose back to $15,000.

This time Mr. A thought he should lock in profits but he wouldn’t do it now. He would sell it as soon as it reaches to a peak of $17000 again. But, Bitcoin fell again and again. Now, it is in the range of $4000-5000, and people are forecasting it will drop down to $1500. So, Mr. A sold it all.

Maybe he had made some money, and maybe he had lost. In either case, he is happy that he is now out of this game. Now, he decided that there is so much volatility in this market. And, then he decided to stay away from Bitcoin.

End of story! But, you know Mr. A’s been watching the rise since and now wondering whether he should buy it again.

But what could Mr. A do differently?

We all know about this volatile market and how tough it is to time the market perfectly. But, if he could have a strategy then he can take profits.

Let’s try the strategy.

A strategy that allows you to build a position and take profits. Can one strategy do wonders? Yes, and it is very simple. You can set your Take Profit target to manage your open positions. By setting a target, and a buy limit gives you the flexibility to abandon with smaller losses if returns are not that positive and earn profits with a proper strategy.

So, why not take extra profits from the extremely volatile nature of cryptocurrencies by implementing leverage on all your trades.

To build a strategy, at first, you need to set different order types and functions that you come across on different exchanges.

Cryptocurrency exchange

To perform trade on cryptocurrencies, you need cryptocurrency exchanges. Now, the question is what is a cryptocurrency exchange?

These are the websites where individuals can buy, sell, or exchange cryptocurrencies for other traditional or digital currencies. The exchanges can convert cryptocurrencies into the major government-backed currencies of any country. Some of the largest exchanges are Bitfinex, Binance, Kucoin, Poloniex, etc. Finding the right crypto exchange platform is important to make sure that you buy and sell cryptos conveniently.

Growlonix is one such exchange platform that allows trading on cryptocurrencies with advanced trading options with several connected exchanges. We support trade on most of the cryptocurrency exchanges on all the crypto assets like Bitcoin, Dogecoin, Ethereum, and more, along with wide order types support assuring profitable outcomes.

As discussed above, about Mr. A, how can you know that how strong your next move should be which may maximize your chances of earning profits?

Setting a Take Profit limit order is actually the solution for traders who want to earn profits by a particular price. This feature will let you make a profit in time and won’t let you lose money. Take Profit orders are the tools that can be used on the trading software you will be using with your brokerage.

Let’s understand what is Take Profit order?

Take Profit

In crypto exchange trading, Take Profit is an order, with the help of which a trader can register a profit. It is a standing order to sell a crypto asset once it reaches at a certain level of profit. Selling at this particular price ensures that the trader will make a profit on its trade.

Actually, it specifies a certain price above the purchase price, which is chosen by the trade for any crypto asset. If the price of a crypto asset reaches to that limit, it will trigger the sale automatically. And, if the price doesn’t reach that limit, the trade will not happen.

Take Profit orders are the limit orders that can be used either to buy the assets at a low price or sell them at a higher price. Actually, it is a short-term strategy that is useful for those traders who want to take advantage of a quick rise in the price of cryptocurrencies.

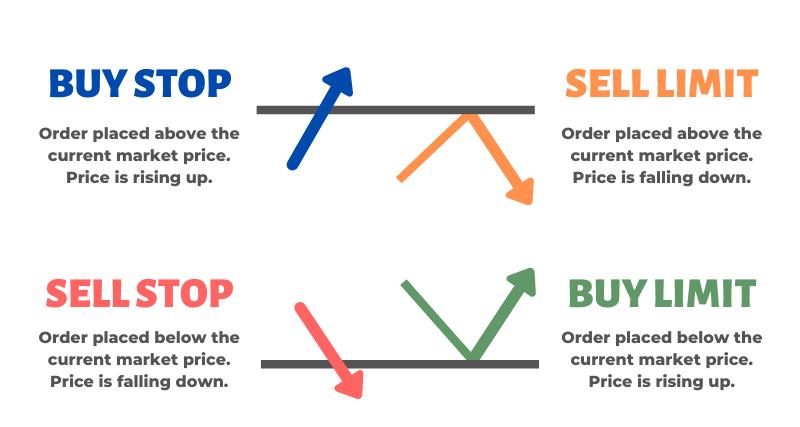

Traders use Take Profit orders by specifying them as Market order or Limit order instructions to be executed once the market price reaches at the pre-defined triggered price. There are two types of Take Profit orders:

- Take Profit Limit Order – Once the price has reached your desired triggered price, you will automatically place out a limit to secure your unrealized gains.

- Take Profit Market Order – Once the market price has reached your desired triggered price, you will automatically execute this order to close out the trade.

These orders play a crucial part in the expert trader’s strategies. Whenever prices begin to rise, these orders serve as an upper limit ensuring that your crypto assets will be sold immediately before prices begin to fall.

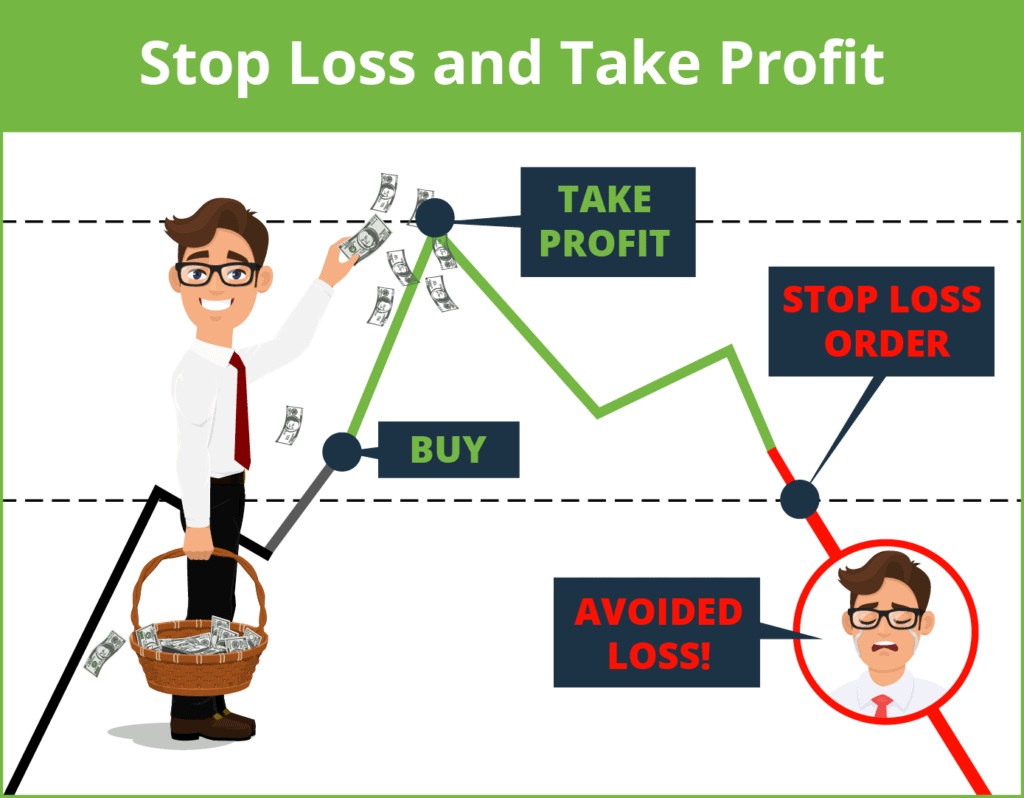

Take profit orders work great with stop-loss orders which triggers the sales of stocks as soon as the prices reach a pre-determined low point. This helps traders to cut their losses and protect themselves if the prices continue to fall. Stop-loss orders are just the opposite to Take Profit orders.

Key Takeaways Take Profit (T/P) orders

- T/P orders are the limit orders that are closed when your crypto asset reaches at a specified profit level.

- Beneficial for short-term traders interested in profiting from a quick bump in the asset’s costs.

- Limit prices for T/P orders are placed either using fundamental or technical analysis.

Basics of T/P order

Most traders use T/P orders with stop-loss orders to manage their open positions. If the price increases to take profit point, T/P order is executed and the open position will be closed for a gain. And, on the other side, if the asset falls to a stop loss point, the Stop-Loss order will be executed, and the position is closed for a loss. The difference between market price and these two T/P point and S/L point help defines the trade’s risk-to-reward ratio.

The benefit of using Take Profit orders is that the trader doesn’t need to worry about manually executing the trade. At Growlonix, you can easily set your T/P limit and can execute the trade effectively for profits.

Take-Profit orders are executed at the best possible price regardless of the underlying behavior of the crypto asset. The stock could start to breakout higher, but as the T/P order is executed at the very beginning, resulting in higher opportunity costs. Usually, traders with long-term strategies don’t support T/P orders.

Often the Take Profit orders are placed at levels that are defined by other forms of technical analysis like chart pattern, money management techniques, or support and resistance levels.

Example

Let’s understand it with an example:

Suppose a trader spots an ascending triangle chart pattern, and he opens a new long position here.

If the stock has a breakout, he expects that it will rise to 15% from its current position. And, if the stock doesn’t breakout, he wants to exit the position quickly and move on to the next better opportunity.

Here the trade might create a T/P order that is 15% higher than the market price to sell the order automatically when it reaches to that level. And, at the same time, they may place a stop-loss order which is 5% below the current market price.

Here the combination of T/P and S/L order creates a 5:15 risk to reward ratio. By placing T/P order, the trader needs not to worry about tracking the stock diligently throughout the day as there is a well-defined risk-to-reward ratio and the trader knows what to expect before the trade occurs.

So, a T/P order allows limiting your risk or exposure to the market by exiting the trade as soon as the market shows a favorable price for you.

Pros and cons of Take Profit orders

There are several benefits of trading with profit target, but there are some drawbacks too. Let’s go through these:

Pros

- Ensures a profit

- Minimizes risk

- No second guessing

- Good for short-term traders

This order is executed when the trader makes some level of profit and if the order is executed, you will earn profit for sure. Traders who choose take profit orders don’t have to decide if it is better to buy or sell as the trade happens automatically without the risk of second opinion.

Cons

- Not good for long-term traders

- May not be executed at all

- Can’t take advantage of current market trends

These orders are not appropriate for the long-term traders who are willing to sit out as per more ups and downs in the market so as to earn larger profits at the end. Having a T/P order doesn’t guarantee that the sale will happen at all. Like if the market never rises to a T/P level which you have set, you may have to sell it with a loss.

Trading effectively at Growlonix with stop-loss and take-profit orders

A great way to place stop-loss and take-profit orders is on the crypto’s trading chart’s support and resistance. The expert traders usually do technical analysis on cryptocurrencies based on previous ups and downs in the market.

Using the best crypto trading bot like Growlonix is essential to execute the successful trades. We allow you to set your preferred entry and exit orders including the initial price where you want to set your stop-loss and take-profit orders. Since it is nearly impossible for one to monitor the market all day long, we automate the trades for you, based on your strategies to make sure that you do not miss out on earning profits.

How to place Take Profit:

- Select Take Profit order.

- Select Base and Quote coin.

- E.g. Market: BTC/LTC

- Select the number of coins that need to be sold.

- E.g. 10 coins. (quantity could be in the fraction)

- Now, click on the drop-down menu near Take Profit. It will pop up with 3 options: Market, Limit, and Trailing. Selection of an option means when market price (bid price) rises to the Stop value, the selected order in the drop-down menu will be executed (Market Sell, Limit Sell, or Trailing Sell).

- E.g., if the current bid price of LTC is 0.011184 BTC.

- Stop value can be a place at 0.011210, 1% above the current price.

- Suppose the market hit 0.011210. This will trigger subsequent orders. Below are the possibilities:

- Market Sell: A Market Sell order will be placed.

- Limit Sell: A Limit Sell order will be placed having the limit value mentioned during placing the order.

- Trailing Stop Sell: A trailing Stop sell order will be placed with the mentioned offset during placing the order.

Note: Always make sure the Stop Value is higher than the current Bid Price.

A hypothetical example:

- Case 1 Take Profit with Market Sell:

Suppose the current bid price of BTC is $100. Now someone placed a Take Profit with Market Sell order, for 1 BTC coin with a stop value of $110. Now when the BTC market bid price hits $110, a Market Sell order will be placed at $110.

- Case 2 Take Profit with Limit Sell:

Suppose the current bid price of BTC is $100. Now someone placed a Take Profit with Limit Sell order, for 1 BTC coin with a stop value of $110 and a Limit value of $115. Now when the BTC market bid price hits $110, a Limit Sell order will be placed with a limit value of $115.

- Case 3 Take Profit with Trailing Stop Sell:

Suppose the current bid price of BTC is $100. Now someone placed a Take Profit with Trailing order, for 1 BTC coin with a stop value of $110 and a Trailing offset of 3%. Now when the BTC bid price hits $110, a Trailing Stop Sell order will be placed. Let’s say the market hit $120 and then start correcting. When the market bid reaches $116.4, a Market Sell order will be placed.

Take Profit is a key element of the trading success because it is the only moment where a trader actually realizes a profit on the short-term strategy. These orders have some similarity to Stop Order. A stop will execute whenever the prices move against the trader’s position, while a T/P order does the opposite. It executes if the price moves in the favorable direction to the trader’s position.

For example:

If you have bought long contracts at $10,000 and you are expecting an optimistic movement to what you have identified as the next level of resistance at 10,300. Now you can set a T/P of around 10,300 to guarantee that the trade closes if that particular price is reached and then you will secure your unrealized profits.

A lot of traders use multiple take profit levels to make sure that they progressively secure their profits as long as the price moves in the desired direction.

Take Profit orders are used to set a target profit price on an unleveraged spot trade or a leveraged long or short position. The profit price is to be set in terms of absolute price. As with Stop Orders, Take Profit orders can also be used to open positions. Take Profit triggers the next order type when the last market price hits the stop price. The next order can be Market Sell, Limit Sell, or Trailing Stop Sell.

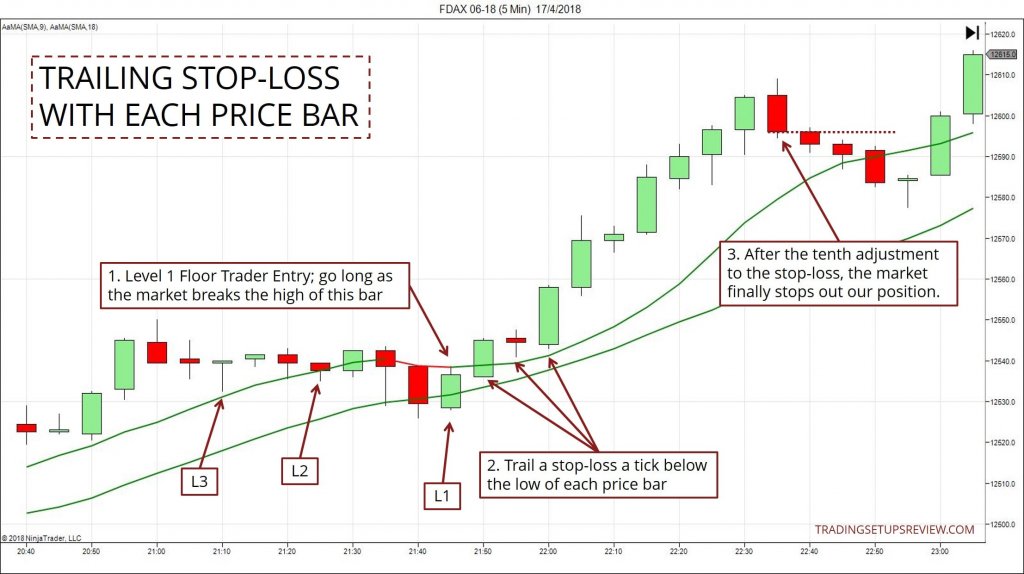

Trailing Take Profit

Trailing take profit is an advanced market order type that is set by choosing the regular take profit and the trailing distance. Once the Take Profit order reaches at the trailing distance, it will work as a new selling point to perform the trade. At any time, when the profit reaches at a new point, the Trailing Take Profit order moves up so you will be able to stay in the trading until there is a hike in prices.

This strategy works great for a long trade and its main purpose is to maximize your profits. Trailing take profit is a safe way to secure profits without having to monitor the chart continuously and adjust your TP levels when a crypto asset you are trading reaches higher. It’s just like placing a Take Profit order with Trailing stop loss, but better than that.

How it works?

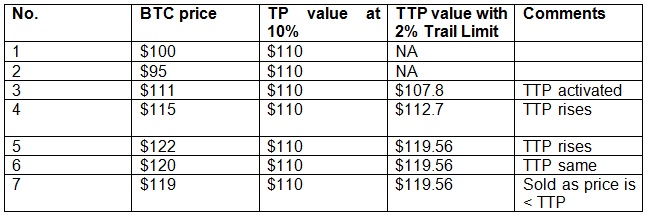

Let’s say you have bought BTC for $100 and set up take profit at 10% with the expectation that the deal will close when the predetermined $110 price is triggered.

With a Trailing T/P order, if the price continues to rise, you will not be stopped at $110, and your trade will only stop if the price starts falling. For Trailing T/P order, you need to define the trailing limit i.e. how much the price will be allowed to fall from the peak before selling. Let’s set the trailing limit at 2% and understand what happens to the TTP value:

Take profit Vs Trailing Take Profit when bought at $100

As a result, the transaction is closed at $119.56 with a 19.56% profit. This could be achieved by leveraging Trailing Take Profit.

Conclusion

Setting the correct Take Profit registration is important. Don’t forget that T/P should be clearly described in the trading system and its efficiency should be tested based on charts and historic data. If you have automated your trading strategy at Growlonix, make sure your Take Profit is adjusted as per the market analysis.

do you have to place a sell order on your binance exchange then a trailing stop sell order on Trailing crypto platform…how do you sell a coin and what would you expect to see on the trailing crpto platorm wallet will ir be under available or pending.

How would you know if the trailing stop sell has been activated….please could someone explain step by step how the process will work and what indicators you are to look out for to know that your command to trailing stop has been activated and is will be successful.

All advance orders remain on Growlonix platform until final execution. At the time stop is hit either a market order or a limit order is placed on the respective exchange. You can click on refresh icon in open orders tab to get the current status of all open orders including trailing ones. What should be the offset value is an individual decision and depends on many factors. we shouldn’t give any recommendation on that.

“Case 1 Take Profit with Market Sell:

Suppose the current bid price of NEO is $100. Now someone placed a Take Profit with Market Sell order, for 1 NEO coin with a stop value $110. Now when the NEO market bid price hit $110, a Market Sell order will be placed at $115.”

Why $115? Should not there be $110?

Yes it should be 110.

Thanks for correcting.

My undertanding is that the Market Sell order value in Case 1 in hypothetical example above should be 110 and not 115.

Thanks for correcting.

I see that you can’t enter a stop price below the current price. How would you use this Take Profit function on an open short position, considering to take profit the price has to be lower? Particularly using the Trailing option.

To enter stop price below current price use Stop Loss order to open a short position.