Table of Contents

Growlonix order form explained.

Main Order Form

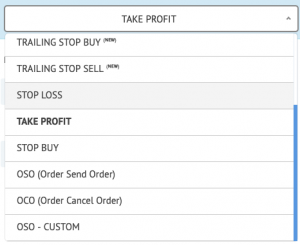

Order type selector

Coin selector

Quantity and Total

- Commonly there are two ways to specify the amount of currency need to be traded, Quantity and Total. Quantity tells the amount of quote currency need to be traded.

- E.g. for sell order once can specify the 10 XRP need to be sold.

- Similar to this, using Total one can be used to specify the amount of base currency need to be traded.

- E.g..1 BTC need to used to buy XRP.

- On the right side of both quantity and total has a percentage button (%). This means when it is pressed then the entered value will be treated as relative quantity rather an absolute. The relative quantity is calculated during the execution of an order.

- E.g. if one inputs 10% in XRP Quantity, then mean 10% of this total XRP balance will be used in final trade (exit trade).

Ask and Bid selector

- As we all are aware that any trade there are two prices, bid and ask. Bid price represents the price at which a buyer is willing to pay whereas ask price represents the price at which a seller is willing to sell. Nearly always there is some gap between these to prices.

- For every order type, bid and ask price are pre-embedded which refreshes automatically after a few seconds. On click of any of them, some common fields of the form automatically fill up e.g. stop price, conversion from total to quantity or vice a versa.

Offset (Trailing Orders)

Quick percentage coin fill

Sub Order in TP and SL

Demo (Paper Trade)

Trigger and Advance Option

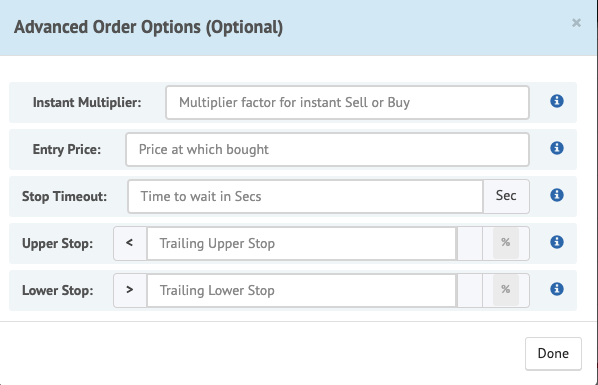

Advance Options

Instant Multiplier

This is used to define a multiplier factor for instant order. Instant order is custom made proprietary Growlonix order which tries to simulate market order and tries to fulfill the order in multiple attempts. Instant order first place a limit order on exchange at market price. If limit order doesn’t fulfill or partially fulfill, then Growlonix cancels that limit order and place a new order with the lower price for a sell order and upper price for a buy order. Here instant multiplier comes in picture. Last limit price is multiplied with this factor and a new limit order is placed. This cycle will continue until the order is not fulfilled or 10 attempts (max retry limit) reached.

The formula used for:

- Instant Sell order = (Last Limit Sell Price) * (100 – instant multiplier)/100.

- Instant Buy order = (Last Limit Buy Price) * (100 + instant multiplier)/100.

For e.g., if the instant sell order is placed with the multipler factor at 1% and the current market price is $100. In this case, a first limit sell order is placed at $100, if its order doesn’t fulfill in 50 milliseconds, the limit order will be canceled and a new limit sell order will be placed at $99. This process will go in a loop until the order is fulfilled or 10 attempts reached.

Entry price

Stop Timeout

Helps to prevent orders to execute in a highly fluctuating market. Using it one can add a delay in order execution once the market hits the stop price. If the price drops to or below the Stop Loss level, the system will wait for a specified amount of seconds. After that, it will do an additional check on the price:

- If the price still on or below Stop Loss level, the trade will be sold by Stop Loss;

- If the price rose back above Stop Loss level, the trade will remain open.

Upper stop

Lower stop

Trigger Option

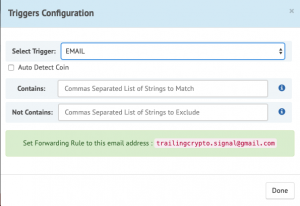

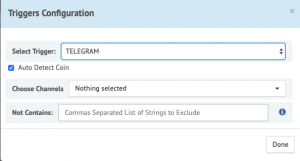

Select Trigger

To select the trigger type either email or telegram.

Chose channels:

Pick multiple public telegram channels.

Auto Detect Coin:

Growlonix is quite intelligent and extract the quote currency form the message. So, quote coin will be auto-filled in order on a trigger message.

Contain (Optional):

A comma-separated list of words which will be used to filter the email message. A message will be only considered if all specified words are present in the message. E.g, if the input is “profit, signal”, then a message will be considered trigger only if “profit” and “signal” is present.

Not Contains (Optional):

A comma-separated list of words which will be used to filter the telegram/email message. Suppose someone entered text “risk, short, loss”, then any telegram message containing these words will be filtered out.

NOTE: Growlonix by default filter most of the non-signal message itself, so one can leave these fields empty.

Open Order Table

Order Action

Pause

Play

Exit

Cancel

1. Pause: Will pause the order. This means the order will not able not execute even if the market hits the stop target hit. This almost equivalent to dead order which can resume anytime with the press of resume button.

2. Resume: Will resume order from pause state.

3. Force Exit: On press, the order will exit straight forward. Menas sell order will be immediately exited and buy order will be immediately filled.

- This is especially helpful in the panic situation.

- It is also helpful when one sees a sudden rise in profit and wants o exit that time.

- Similarly, if one sees suddenly drop in price and wants to immediately buy coin instead of waiting for trailing stop hit.

4. Cancel: Will cancel the order.

Actually the bot seems to have a lot of promises from what I have read about it here though I nearly lost all my money the first time I tried it not because the bot wasn’t good but because of it’s complexities as a beginner. Then the interface wasn’t as it is now. That was around August 2018. But this time around l visited your site and saw that you had modified the platform and it’s simpler than it was then though still a bit complex in the eyes of the beginner. It’s good anyway but I will suggest that… Read more »

Hi, Thanks for your feedback. We are working on new automated trading interface for beginners that will address the issue you are presenting.

We will keep evolving the platform to suit everyone’s needs. Thanks again.

i can’t find documentation about using the template feature while creating an order. I figure your response would fit best on this webpage.

I saved a template detailing take profits and stop loss instructions for an OSO Sell order. When i revisit the OSO Sell order form in a new trade, i can’t figure out how to load the saved template. i know the template is saved because i can see the label when i click Save Template and click on the Label field.

You need to load an already saved template by clicking that particular template inside order type dropdown. you can find it inside order type dropdown with same label as you defined while saving the template.

There is a BIG Mistake:

Pair LTC/BTC

LTC-is Base Currency

BTC -Quote Currency (prices are QUOTED in BTC)

You are right. Our nomenclature is opposite of what is present on exchanges. We have planned to unify this as per standard nomenclature in future. It won’t make any difference in trades.

The features of the bot is really awesome, but we need one more thing to set the risk reward properly in futures trading. Is the bot able to calculate order size based on the stop loss price. Ie if we put risk 5%, then the order size should be calculated as 5% loss when hit stoploss

Investment quantity based on risk % is already available. Please have a look at this article – https://www.growlonix.com/support/article/telegram-signal-orders#47_Risk_Percentage_per_Trade