Harness the volatile market with Telegram signals and Tradingview signals with email trigger.

Table of Contents

Brief history

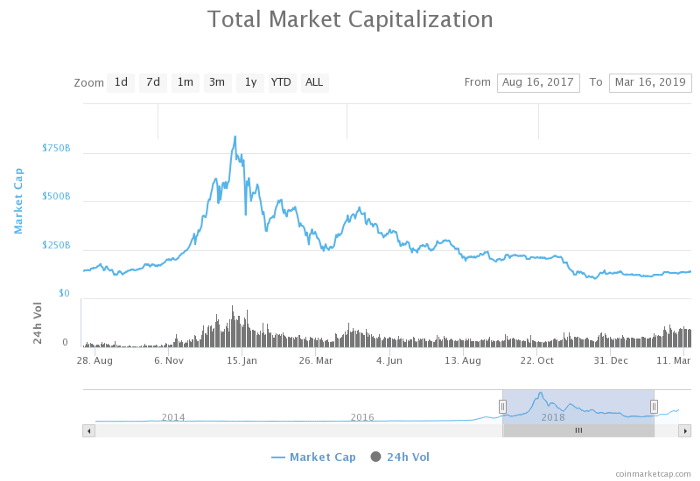

I’m doing crypto trading since last 1.5 year. Throughout the experience, I saw many ups and down. There was the time when I saw where Bitcoin (BTC) was surging every day by 5–10% and within a short span, it reached $2,000 mark. That time there was a widespread rumor that BTC can touch 100K anytime soon. During that time, everyone was talking about Bitcoin and alternative currency. Even altcoin was surging that time with the market. Total crypto capitalization crossed $800 Billion, a remarkable point. Every investor was happy and making money.

In any security ( be it stock, bond, derivative or crypto), ups and downs are the two sides of the coin. One such not forget that law of average applied in crypto too. This what happened with bitcoin. It starts falling from $20,000 then reached to $15,000, then touched $10,000 and finally stopped at $3,100. So, its nearly 85% drop. The drop did take place in a day but happened in several months. Every time BTC fall, it momentarily stuck at some resistance and then again if it starts falling.

The volatility of the crypto market.

The reason I’m pointing this historical fact to uncover the volatile nature of the crypto market. Because of this, it is very difficult to make a profit in the long run. To make a profit, one needs to constantly attentive and keep track of the news and rumors in the market. Typically BTC doesn’t go up or down more than 5% in a day. However this not true for altcoins. If we see historical data off alt coins, they can surge as high as 100% in a few minutes. This type of volatility gives an immense opportunity to mak profit. Commonly people refer to such phenomena as a pump or dump coins. Usually, in such surge, thousands of people try to buy the same coins at the same moment. The one who buys first takes the most part of profit same time who buy last tends to make loss.

Algo trading, reap profits out of volatility.

I saw here an opportunity to make a profit by capturing these spikes by a computerized trading algorithm. Before building a bot myself I found Growlonix. The site was providing exactly what I was looking for. Growlonix, has many advance order like Trailing Buy/Sell, Take Profit, Stop Loss, Stop Buy, OCO, OSO, Custom OSO. I really like the idea of custom OSO where I can combine any two order which gives me literally the power to do anything crazy. Then I saw Growlonix has email trigger option and Telegram signal too. Using this I can set a trigger on any order. This mean order will open on a telegram signal or email.

I’m also aware of other Trading tools/bots like CryptoHopper and 3Commas but for the small investor, their subscription prices are way too high. Also, 3commas bot is commission bases, where they take some percentage of profit. When I checked Growlonix prices, I was like “Are you kidding Me”, how could one give these all things for free.

I give a try with dummy order for paper trading. I saw things were working good. Then after some glitches, I was able to set telegram trigger order and email trigger orders. Both were working fine and did testing with a small fund. At this point I was all set to capture a big spike with real money:😈.

Crypto Telegram signals

I created a couple of telegram trigger order with popular channels like Trailing Crypto Coach, Crypto Hal, Premium Signal Forward and so on. I also put a couple of email trigger orders using trading view charts. Now, I was waiting to make a profit. And the next day I saw some trading activity in my account as expected. My heart was pumping past if I made some profit. Yeah, I made some profit, not that great number but decent enough to buy one beer bucket for free. Next day I fine-tuned my strategy based on my past experience.

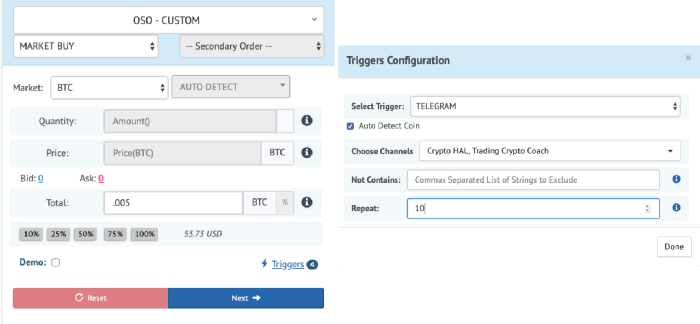

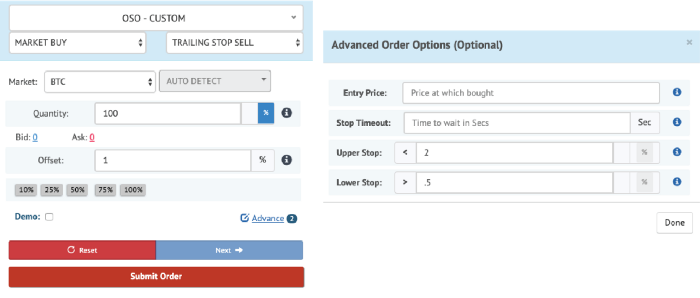

This is the strategy I used for telegram trigger:

- Custom OSO

- Primary order: Market Buy + Select telegram channels.

- Secondary order: Trailing Sell + Advance Options: Offset 1%, Upper Stop 2%, Lower stop .5%

This basically means, if coin spike then at 2% I sell all the bought coins. Lower stop put control over my losses and ensure I will not lose more than .5%. It like I can gain 2% max but will lose only .5%. I put repeat = 10 for telegram trigger order.

Now, all ingredient are in places, let’s wait for a day. Next day, I checked my trades. I was like ‘Ohh my gosh, someone saves me’ I made 6.3% profit without any work.

To be honest, I’m not sure how many people are working behind Growlonix and not sure even they are making money, but I believe there must be many people outside like me who are able to make a profit because of this amazing tool. Recently I donated some of my profit to their crypto wallet.

Such like-minded people are helping to cherish cryptocurrency trading.

PS: Excel sheet for the signals analysis.

What is the benefit of having an upper stop in the example that you gave? I can understand having a lower stop because that protects your losses, but the 2% upper stop needlessly limits your gains, correct, or am i missing something? Thank you!

Limiting gains will also limit the loss. consider the scenario that price went upto 2.5% and your trailing offset is 1% then it will sell at 1.5% and having a fixed upper target means the moment it crosses that you are closing the trade with 2% profit in your example. Difference is same as using Take profit order vs using Trailing stop order. I hope this clarifies your query.