In March 2019, Bitwise, a cryptocurrency asset management firm, shook the market by publishing a damning report on trading volumes. The paper stated that most of the volumes that were aggregated by popular crypto tracker CoinMarketCap (CMC) were, in fact, fake.

The document goes into detail on how large portions (95%!) of the processed data were illegitimate and created a false sense of inflated trading volumes in the crypto sphere.

Bitwise’s experts compared real volumes with those reported by the exchanges and came to the conclusion that there were big discrepancies between these metrics.

The infographic prepared by Paybis below illustrates the shady dealing of some of these exchanges.

There are over 300 different exchanges on CMC, and Bitwise sampled 81 in their report. The research showed that from the reported billions of dollars in volume, only 271 million were real orders that got executed.

But why would these supposedly legit platforms lie about their trading volumes? Well, the answers are quite simple, really:

- To simulate high liquidity – high trading volumes simulate high liquidity. One might think that when such high volumes are transferred on an exchange, the exchange is highly liquid, which attracts more traders.

- To simulate popularity – top exchanges on CMC receive more media coverage and attention from the public. Large volumes are a good sign of an exchange’s legitimacy and popularity.

- To justify high listing fees – when companies release new cryptocurrencies they need to list them to be traded on different exchanges. Markets with high volumes can justify high listing fees as they should be able to provide more trading opportunities.

When considering these outcomes, it becomes clear why some smaller exchanges would want to increase their standing on CMC.

An interesting fact that can be singled out in the document, is the presence of 10 big exchanges that report real volumes.

Table of Contents

The “Bitwise 10”

Out of the 81 exchanges probed, these 10 were the only ones found to be reporting their real volumes:

Binance – Bitfinex – Bitstamp – Bitflyer – Coinbase – Kraken – Gemini – itBit – Bittrex – Poloniex

Here’s why Bitwise suggests that these exchanges should be considered legit over others in the study.

First, except Binance, all of these exchanges are registered as Money Services Business with FinCEN. However, Binance has since then become the largest and most important cryptocurrency exchange in the world.

Second, five of those 10 own a Bitlicence. This license shows that these exchanges comply with US regulatory crypto standards.

And finally, these exchanges aren’t some shady backdoor businesses. They are recognized in the world and hold offices in various countries around the globe.

But having only 10 legit exchanges out of 300 is a bit worrying. So, what has been done since the rapport?

The CMC overhaul

Experts and a large part of the crypto community blamed CMC for these fake volumes. After all, as we can see in the report, it is not very difficult to discern real from fake volumes.

Shortly after the release of the Bitwise paper, CMC introduced a new metric called “liquidity” in November 2019. By filtering exchanges based on liquidity, users could effectively verify order execution on different exchanges.

But in April 2020, Binance managed a deal to purchase CMC, to the dismay of many enthusiasts in the community. This move was met with mixed reactions as an independent aggregator being under the ownership of a cryptocurrency exchange could lead to bias.

To put everyone’s minds at ease, Binance decided to let CMC work independently and let them continue reporting market statistics unhindered.

So what has really changed with CMC since then?

Rankings redesigned and reviewed

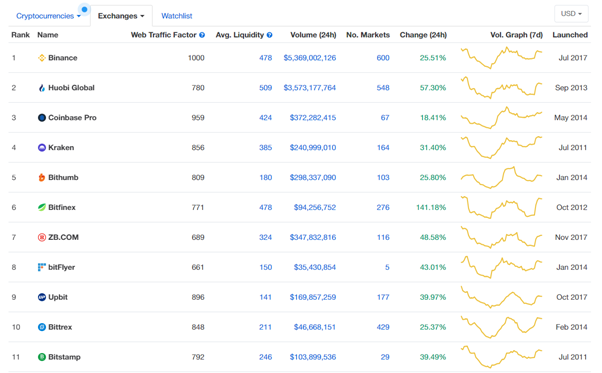

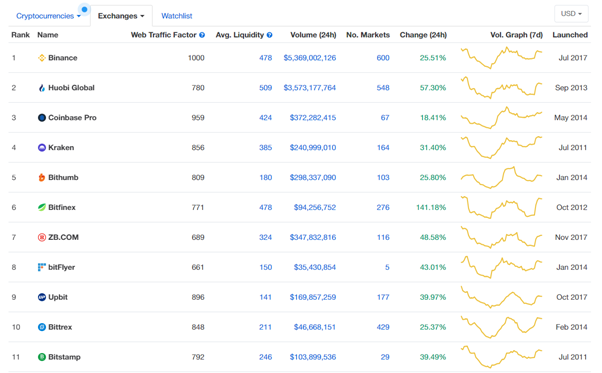

The entire “Exchanges” page has seen an overhaul. In addition to Liquidity, other metrics were introduced. These would help traders make an informed decision before depositing their funds on an exchange.

Let’s have a look at the main changes:

- The Web Traffic Factor – this metric is provided by referencing data from multiple web traffic solutions and giving a score of 0 to 1000. The higher the score, the better.

- Average Liquidity Scores – here CMC ranks exchanges by averaging their Liquidity Scores, again from 0 to 1000.

- Additional Info – some pertinent information has been added like the number of market pairs and the year the exchange went live.

There’s a lot to like in this redesign of the metrics. Users are able to quickly discern liquid from illiquid exchanges and pick one that best suit their trading needs.

Want more market pairs? Go for Binance. Do you prefer to trust a household name that has been around for ages? Pick Kraken!

All of this accommodates the user and helps with a more secure, safer crypto experience.

But there are some caveats to this model. Remember how we said Binance owns CMC now? While they haven’t been openly promoting themselves on the platform, there’s nothing that could stop them if they wanted to.

They also have some influence on what exchanges are listed, which could hinder the service as a whole. As crypto enthusiasts, we should stay vigilant on what happens down the road and if the Binance acquisition could ultimately bring more harm than good.

Conclusion

It has become clear that we can look at fake volumes with some misplaced nostalgia. They are becoming a thing of the past when the space was more naive and easily manipulated.

The wild west days seem to be over, with major participants in the sphere doing their best to improve the perception of crypto to the general public. Decentralized finance is growing every day.

The market has evidently matured and we have high hopes for things to come.