From the most stripped down perspective, forex trading is simply a collection of orders from a trader to the broker. The order gives explicit instructions to the broker to perform certain actions under certain conditions. Sometimes, the broker sends orders to a trader, for example, to top up their accounts to avoid automatic exiting of a position.

For every order that a trader sends to the broker, the result is either to increase profits earned or to hedge the account from risk. In forex trading, the rule of thumb is that if the market goes against your position, it is best to limit losses than to lose the entire capital. The buy limit order is one of the most crucial orders for this purpose.

What is a buy limit order?

The SEC defines a limit order as one where a trader specifies the exact price at which to buy or sell a security. Once the broker receives the limit order, it is their obligation to execute at the set price or better. Therefore, if a trader sent a buy limit order, the trader would execute the trade at the limit price or a lower price. For instance, assume that you want to buy the EUR-USD pair at 1.1089 hence you set the price as the limit price. The moment the pair reaches that price the order will execute.

Simply, the buy limit order tells the broker that the trader is willing to buy a currency pair at the given price. However, this order also says that the trader is willing to have the order execute at the lowest price possible. Ultimately, the trader wants to limit the downside while maximizing the upside of the trade position.

This is how the buy limit order works

Let us consider a real life example of how the buy limit order works. For this example, we shall use Growlonix. This crypto trading platform brings together 15 crypto exchanges onto a single platform. To use the platform, you have to choose your favorite exchange from the drop down list. In this case, we shall use Bittrex.

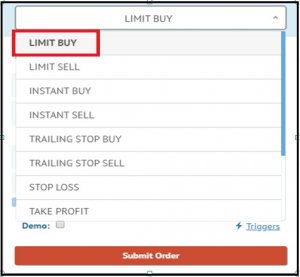

Once you choose the exchange, a trading window will open. We can go ahead and see how the buy limit order works. On the trading window, click on the first box atop and choose ‘LIMIT BUY’ from the drop down list.

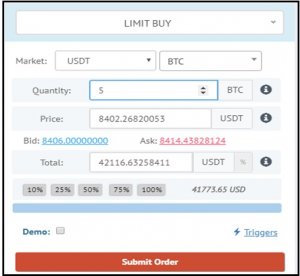

When you choose the kind of order you want to place, the next thing you to do is to enter the parameters of the order.

In our case, we will choose the Tether (USDT) market where we shall trade Bitcoin (BTC) against USDT. Next, specify the quantity of the base currency (BTC). Here, we will specify the quantity of BTC in our order as 5. Then, we need to specify the limit price (the price at which we want the order to execute). Usually, the limit price is quoted in terms of the quote currency or the market, which in our case is USDT. Since we have set the Limit Price at 8402, the LIMIT BUY order will execute the moment the pair reaches this price.

In the screenshot below, the blue line shows the limit buy price.

Once the BTCUSDT pair touches the line, the broker will enter the trade automatically, as shown below.