Table of Contents

Bitmex Margin Trading

Growlonix can be used to perform advanced trading operations on Bitmex like Trailing Take Profit, Conditional Buy, OCO, OSO, Trigger Based Custom OSO, etc.

Understanding Order form terminology

- Order Type: Select desired order type from dropdown. One difference here from Spot trading is Buy/Long and Sell/Short are interchangeably used.

- Market: This field represents the contract you wish to trade. Note here that XBT and ETH contracts have USD as base while remaining contracts have XBT as base.

- Quantity: Number of contracts you wish to buy/sell. In this example we are buying 5 XBT contracts. Note this can’t be in decimals. Contracts can only be a whole number. We will truncate any decimal while executing a trade.

- Price: Price of contract at which you wish to buy/sell in case of Limit Order.

- Total Cost: Total Cost = Price * Quantity.

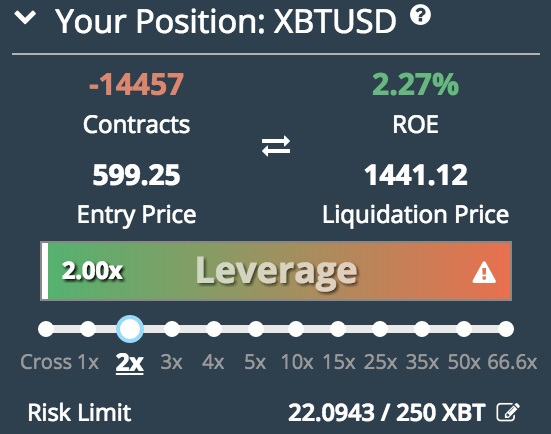

- Leverage: Default is Cross Leverage. You can change it from the slider.

Managing Open Positions:

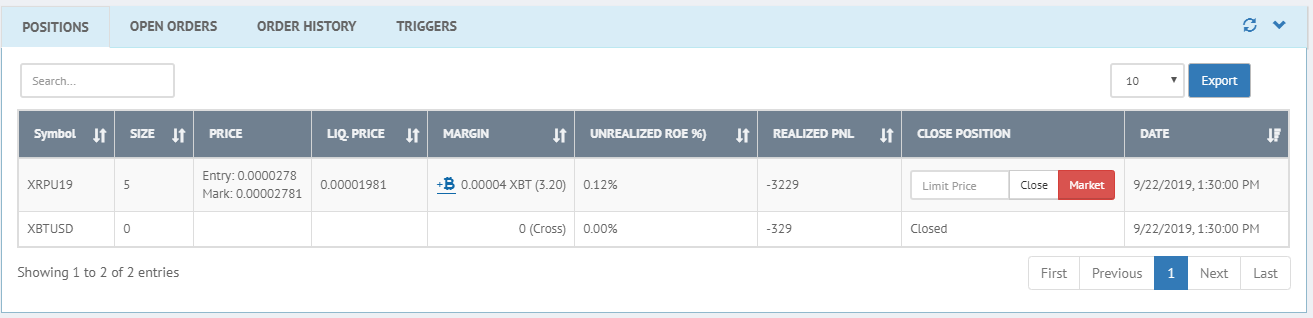

All open positions and recently closed positions will show up in the Trade Positions TAB.

To close an open poistion either Click on Market to close at Market price or Put a desired limit price and press close to place a limit buy/sell order for closing the position.

Note: Margin Transfer in an Open Position is currently not supported.

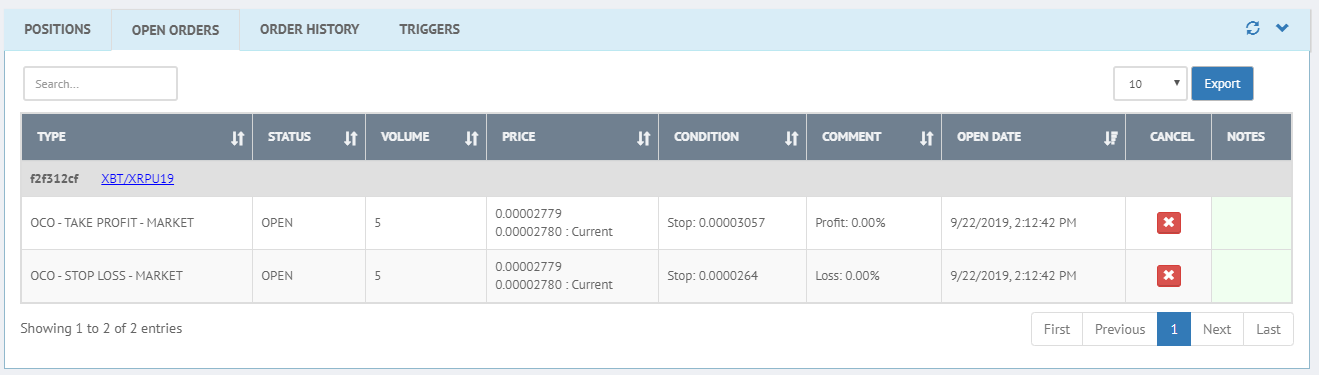

Understanding Open orders table:

Whenever you place an order/trade which is yet to be filled either on Growlonix platform or on Bitmex such as limit order or stop order then it will appear here in Open Orders Tab. Users can cancel it at any time by clicking on cross icon in cancel column.

Wallet Balances:

On Bitmex you will see only BTC/XBT in wallet balance even if you have bought XRP. Because here XRP is the Contract you bought not the Coin as opposed to spot trading on other exchanges. That’s why auto-fill percentage shortcuts are disabled in case of Bitmex.

Total Cost:

Keep in mind while placing a Trailing Buy or Stop Buy order that Total Cost here is different than what it is generally in Spot trading.

Total Cost = Price of Contract * Quantity of Contract

Exapmple1: XBT/XRPU19 If you wish to buy 5 contracts of XRP at 0.0000279 price then Cost = 0.0000279 * 5 = 0.0001396. So if you are placing a trailing buy order to buy 5 XRP contracts then you need to specify cost = 0.0001396

Example2: XBT/USDT – If you wish to buy 5 contracts of XBTUSDT at 10015 price/contract then Cost = 5* 10015= 50112.5

For more information about different terminologies in Margin trading at Bitmex please go through their official documentation we have tried to follow the same principles.

Bitmex Official Documentation

Trading cryptocurrencies is one of the best ways to make money in the crypto market. Usually referred to as a volatile market, crypto trading can be highly rewarding and extremely risky at the same time. Among several crypto trading methods, margin trading is getting huge popularity among crypto traders.

Even though margin trading is the most risky option, it is also an enormously rewarding form of trading crypto assets. In this trading form, usually, the trader’s trade with some extra amount borrowed on the basis of money they already have. This method is also known as leverage.

For example, say, you have $100 and you leverage $1000 on this existing $100 to trade is known as margin trading.

This trading method is good for veteran traders but also risky at the same time as they may also incur huge losses in margin trades.

However, if you are good at crypto trading, you may start trying the margins for smaller amounts. Bitcoin and many other popular cryptocurrencies are famous for their volatility in the crypto trading market which sees price fluctuations in shorter periods.

There are many different platforms in the crypto space for traders who want to make profits from volatility. If you want to turn the falling market into an opportunity to make profits, you may consider margin trading. And, BitMEX is one of the most popular crypto exchanges that allow its users to trade with a leverage of up to 100:1 and providing traders the opportunity to amplify their gains as well as potential losses.

Let’s understand,what is BitMEX?

BitMEX stands for Bitcoin Mercantile Exchange. As the name suggests, it provides trading services through Bitcoins. It is the largest crypto exchange in terms of traded volume. BitMEX also offers the possibility to trade with margin/leverage, which suits perfectly for professional traders. It deals with crypto and futures margin trading with a leverage of your choice.

What makes BitMEX different from other traditional spot exchanges is that it allows users to trade with leverage. This is specifically useful to the traders who do not have enough funds to perform a large trade but they are certainly sure about the rising or any other specific direction of the market.

Before moving further on how BitMEX margin trading works? Let’s understand leverage/margin trading.

What is leverage trading?

Sometimes referred to as margin trading, it is the practice of trading assets. And, in this case, it involves borrowing funds to amplify potential returns while buying or selling cryptocurrencies.

When you leverage to trade, you can access the increased buying power and may open positions that are much larger than your actual account balance available for crypto trading.

For example: If you have an account balance of 5 BTC, and you want to place a trade with a margin of 10:1, you can open a position worth $50 BTC or BitMEX. This further means that if the market moves in your favor, you can access 10 times the profits. However, it also has the effect of magnifying losses because there are chances that the market may move against you.

Growlonix is one of the best crypto exchanges trading platforms that can be used to perform advanced trading operations on BitMEX like Trailing Take Profit, Conditional Buy, OCO, OSO, Trigger Based Custom OSO, etc.

How does BitMEX margin trading works?

Say, the value of Bitcoin is 50K USDT and you are using a 10X margin on the BitMEX margin trading tab. By this, you can easily buy ten Bitcoins for the cost of one. Here, the exchange lends you the remaining amount using your 50K USDT as collateral.

So, here if the price of Bitcoin increases by 10%, you can secure a 10% profit on ten bitcoins.

Sounds great! Isn’t it?

But what if the price drops by 10%? Of course, you will lose all your collateral.

BitMEX offers margin trading for different cryptocurrencies including Bitcoin, Bitcoin Cash, Cardano, Ethereum, Ripple, and Litecoin. Although the platform supports the possibility to trade with leverage, not all cryptocurrencies have the same maximum leverage level available.

Reasons why pro traders prefer BitMEX margin trading to other platforms?

- Low fees

- Very user-friendly

- Easy to handle interface

- All professional order types provided

- Trading engines work well without any glitches

Trading on BitMEX is a bit different from other platforms as these platforms allow you to directly trade the coins in your account meaning you directly buy or sell bitcoins while you execute orders.

But on BitMEX, you open a position where you think the price will go on, so as to gain the price difference as your profits in case the trading goes successful. You are buying contracts for long or short trades and every trade must be closed at some point, i.e. your target.

BitMEX employs two different methods of margin trading listed below:

- BitMEX cross margin

- BitMEX isolated margin

BitMEX cross margin

It allows you to use all the funds in your margin trading account to prevent liquidations. In certain situations, you may lose more than your initial margin for a particular position, but it will prevent you from liquidation.

BitMEX isolated margin

The isolated margin can be used for opening short-term positions and take instant returns. This method opens a position with a liability of only your initial margin. Yes, it only puts your initial margin at risk. As in the case of liquidations, it doesn’t use any of your account balances. It can prevent extra losses but cannot prevent liquidations.

On BitMEX you either ‘long’ or ‘short’

Traders can simply open long or short positions according to the direction in which they think an asset would move.

Long Trades- Opening a long position means buying a contract as you believe it will increase in value.

Short Trades– Shortening is when you sell the contract because you think its price will move down, and then you can buy it at a reduced price.

What are BitMEX perpetual contracts?

A perpetual contract at BitMEX margin trading resembles Futures Contracts in many ways. It allows you to trade on approximately the same reference index price of the underlying crypto asset as which is used in the spot markets. These contracts are great for short-term trading as they don’t have any specific date to expire.

These contracts do not expire or settle; rather they are subject to early settlement.

What are BitMEX inverse perpetual contracts?

Every inverse contract has an already fixed value for the quoted currency. It is perfect for traders who wish to go for long or short US dollars against Bitcoins.

What are BitMEX Quanto perpetual contracts?

These contracts exist for straightforward trading. It offers a derivative whose underlying commodity is dominated in on the currency. The currency settles itself in other currencies at some fixed rate.

BitMEX futures contract

In Futures Contract, the trader doesn’t deal with the current prices of Bitcoin. However, they have an agreement to buy or sell the commodity at a predetermined price at some point in future.

Future contracts at BitMEX allow leverage up to 100Xand there are three different types of future contracts supported in BitMEX including:

- Inverse Contract

- Linear Contract

- Quanto Contract

Features provided by BitMEX

BitMEX offers many features to its users and here are some of them which you can use for your benefit.

- Limit Orders- These orders specify the minimum or maximum price at which traders wish to open a position. It is one of the best possible ways to trade at BitMEX.

- Market Orders – This order type executes at the current market price of the asset. Those traders who need to deploy urgent execution regularly use these orders.

- Take profit orders: Like the name implies, this is where you can start taking profits as the price increases. Opposite of this order applies for short.

- Stop market order: This order executes when the market price reaches the trigger price. This order becomes a limit order when the market price is achieved. This order can be executed to minimize losses of the open positions.

- Stop-limit orders: This order can be used as an alternative to the stop orders, and allows control exits from a position.

- Trailing stop order: This order triggers if the price reverts by an amount equal to the trailing value. A positive trail value indicates trailing buy, and the negative trail value indicates trailing sell.

BitMEX not only allows you to trade on the leverage amount but also enables you to earn profits on uptrend sand downtrends.

Wallet Balances:

On BitMEX you will see only BTC/XBT in wallet balance even if you have bought XRP. Because here XRP is the Contract you bought not the Coin as opposed to spot trading on other exchanges. That’s why auto-fill percentage shortcuts are disabled in case of BitMEX.

Total Cost:

Keep in mind while placing a Trailing Buy or Stop Buy order that Total Cost here is different than what it is generally in Spot trading.

Total Cost = Price of Contract * Quantity of Contract

Exapmple1: XBT/XRPU19 If you wish to buy 5 contracts of XRP at 0.0000279 price then Cost = 0.0000279 * 5 = 0.0001396. So if you are placing a trailing buy order to buy 5 XRP contracts then you need to specify cost = 0.0001396

Example2: XBT/USDT – If you wish to buy 5 contracts of XBTUSDT at 10015 price/contract then Cost = 5* 10015= 50112.5

How to leverage trade on BitMEX?

Follow these simple steps to trade using leverage on BitMEX:

- Register for a BitMEX account- Go through the BitMEX website and register for an account by providing an email address and creating a password in the box at the right of the screen. Make sure to enable 2-factor authentication to provide an increased level of security for your account.

- Deposit funds into your account– Click on the ‘Account’ tab at the top of the screen to be taken to your wallet. Click the deposit button and scan the QR code or copy your wallet address there. Now you can use that address to deposit Bitcoin into your BitMEX account.

- Navigate the trading screen– Click on the ‘Trade’ link available at the top of the screen. Click the tab of crypto that you want to buy or sell.

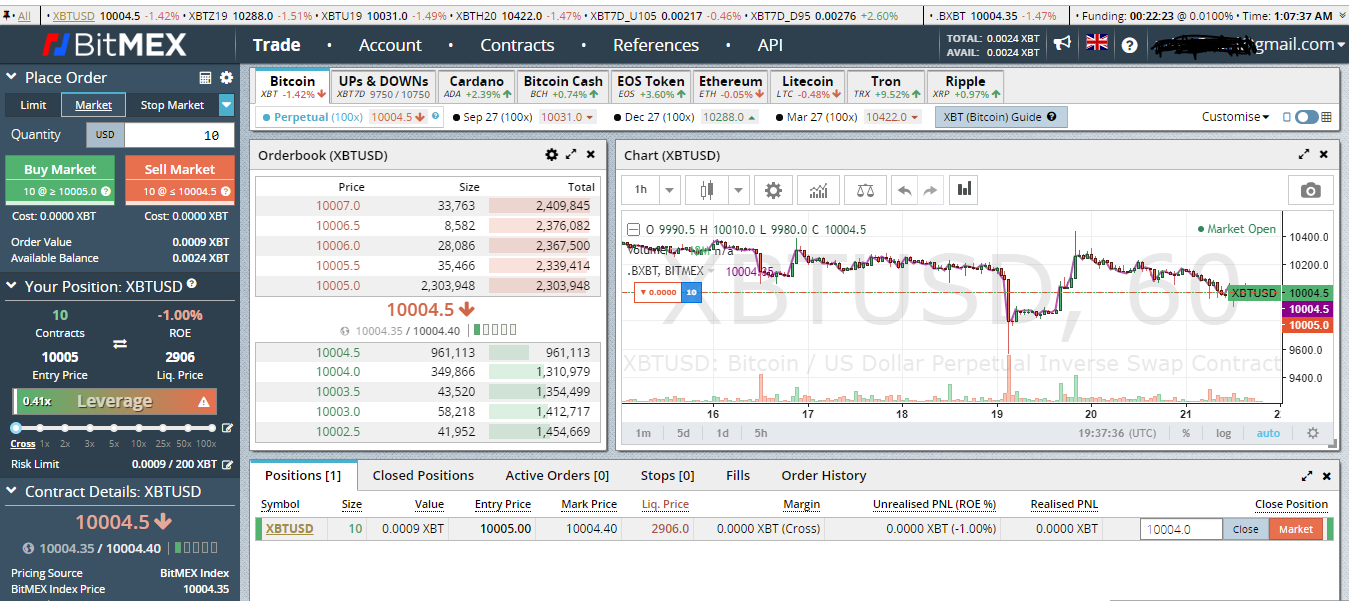

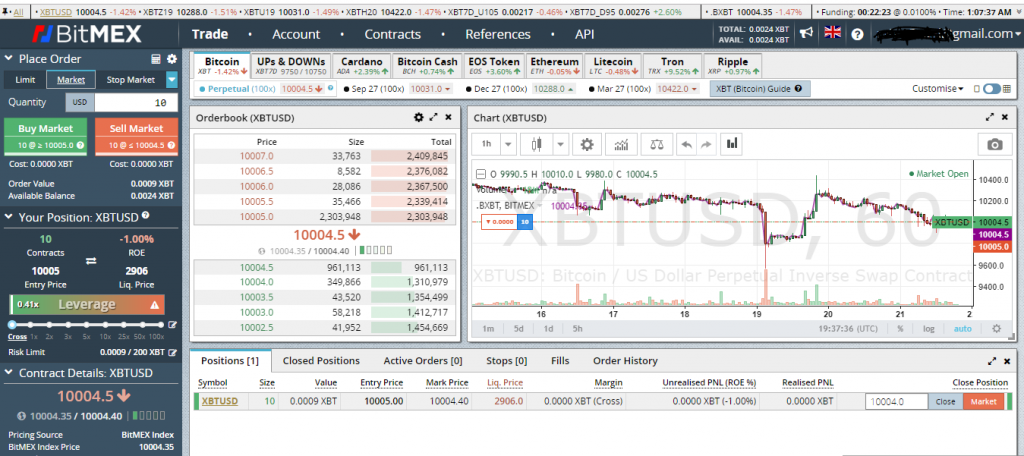

- Enter the details of your position– Here in the order box, select the type of order you want to place. Here in this image, we are using a market order. Enter the amount for which you want to buy or sell in USD.

- Set your leverage– Use the slider below the order box to set the desired level of margin/leverage for your position. Here, we have set the leverage to 5X.

- Review the transaction details– Take some time to review the full details of the transaction done. The ‘quantity’ field here shows the value of your position. But, as you are trading with leverage, the money you are putting at risk is lesser. The ‘Cost’ field here details the maximum amount which you can lose on the position if the market moves against you. ‘Order Value’ shows the value of your position in Bitcoin (XBT).

- Open your position– If you think that price will rise and you are going ‘long’ on the trade, click on ‘buy market’. If you are shorting as you think that the market will fall, click on ‘sell market’. Here the order confirmation screen will appear containing information such as order value, cost, the estimated liquidation price, and the level of leverage.

Whenever you place an order/trade which is yet to be filled either on Growlonix platform or BitMEX such as limit order or stop order then it will appear here in the Open Orders Tab. Users can cancel it at any time by clicking on the cross icon in cancel column.

So, trading on BitMEX is simple. You can quickly place buying or selling orders by clicking on the place order tab under the trading dashboard. Follow these steps:

- Visit the margin trading tab.

- Enter all the required details.

- Click on buy to go long, and sell to go short.

- Your order will be executed depending on your chosen options.

The secret of a successful Bitcoin Margin Trading:

How to make sure that you will earn profits in the long run:

Earning profits generally depends on your trading strategies. You must know a trade setup that works in 50:50 of all cases. Now, you only need to use a risk to reward ratio better than 1:1. That’s it.

The calculation here is relatively easy. In other words:

Only if your expected return is always higher than the loss you would take, you are going to be profitable if every second trade is a winner.

That’s why the risk to reward ratio is so important. Make sure that your Stop loss is always closer than your target.

This means that you have to stick to your trading plan, to the details of your strategies.

While the trade is running, you may never change the parameters. Make sure to avoid those major mistakes that margin traders tend to make in their trades:

- Never move your stop loss further away from your entry

2. Don’t just move your target further away, at least make sure to take the partial profit

3. Enter the trade exactly at the point your trading strategy states.

Conclusion

BitMEX allows traders to make money on the bear and bull markets. This is why; experienced traders love to use it. It provides leverage of 100X which opens the doors to higher returns. Higher leverage means higher risks, so it’s better to research well and calculate risks before beginning.