With the ever-increasing popularity of cryptocurrencies i.e. Bitcoin, Ethereum, Ripple, Bitcoin Cash, etc., people are looking for some ways to invest their money to get some quick crypto gains. Doesn’t it sound easy? But, it isn’t that easy as it seems!

The cryptocurrency market fluctuates a lot, and you know within hours, cryptos can even fluctuate up to $10,000 positively or negatively. Smart investors can utilize these fluctuations to their benefit by trading at the right time using a grid trading strategy which is all about buying low and selling high.

Whether you have tried your hands at actively trading on cryptocurrencies or not, the thought of managing your trading account may be overwhelming for many traders.

Trading on cryptocurrencies requires you to be alert to the market changes and thereafter, creating the trades swiftly. It may keep you awake for long hours and can even make you sleep-deprived. Have you studied the charts, observing how the prices of your assets fluctuate between up and down across a given period?

And, you might have also thought to yourself:

“What if I sell at the top, or buy back in again at the bottom, then I will surely increase my holdings.” Right! And, perhaps you will be worried that you will time your entry wrong, and thereafter, you may end up losing money.

Here lies the value of grid trading bots.

Table of Contents

Grid trading

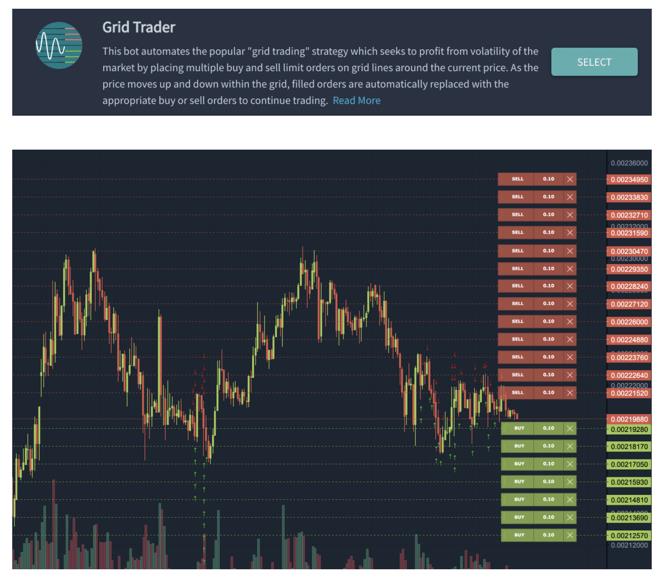

Grid trading is a type of strategy that allows you to make profits by placing a series of long or short orders at the set intervals around a set price. And, this way, it constructs a trading grid.

Grid trading works great and performs the best in volatile cryptocurrency markets when prices fluctuate at specific intervals. In simple terms, this kind of trading involves hedging, or placing simultaneous buy and sell orders at certain levels. This trading approach aims to maximize the profits of traders while the in-built hedging system ensures that the risks are minimized.

Applying a grid trading strategy manually will be very difficult and time-consuming. Online crypto trading bot like Binance trading bots will support you by getting your transactions part done, even if you are not connected to the grid. The best grid bots will assist you in executing the grid trading strategy.

How does grid trading works?

The grid trading strategy keeps making a profit as long as the prices of cryptos are swinging. It lets you make profits from the ups and downs of the price fluctuation in the crypto market and is used best while there is no clear up or down trend for longer periods. The more frequent and bigger the price fluctuations are, the more profitable will be the strategy.

The grid trading works by scheduling or setting up the buy and sell orders within the predefined price range while creating grid-like information. By automatically executing high sell order corresponding to low buy order, this strategy guarantees to make profits each time when the selling price is higher than buying price during sideways price movement.

Binance grid trading is now live, and users can customize and set grid parameters, to determine the upper and lower limits of the grid along with the number of grids. Once the grid is created, it needs to be activated with a single click. With activation, the system will automatically sell and buy orders at the predefined price.

Let’s see how:

In the below chart, every trade will be profitable. Here, the grid trading bot is settled at a price from 3,300 to 4,200 for Bitcoin. Whenever the price hits each target price, the trading bot will make profits.

Whenever a buy order is triggered, a new sell order will be placed (higher than the buying price). And, whenever the sell order is triggered, a new buy order (lower than the sell) will get placed automatically. This means that every time the prices fluctuate between 2 grids, a trade is executed and profit will be earned.

If you are a newbie and don’t know how to set a grid trading bot for Binance, TrailingCryto is here to help. Binance provides a grid trading bot on the Futures market, which is more suitable for those who prefer perpetual futures trading.

How to set up your first Binance Grid trading strategy?

The grid trading bot systematically executes buy and sell–limit orders based on the parameters set by users. Here’s how you can set the first grid trading bot:

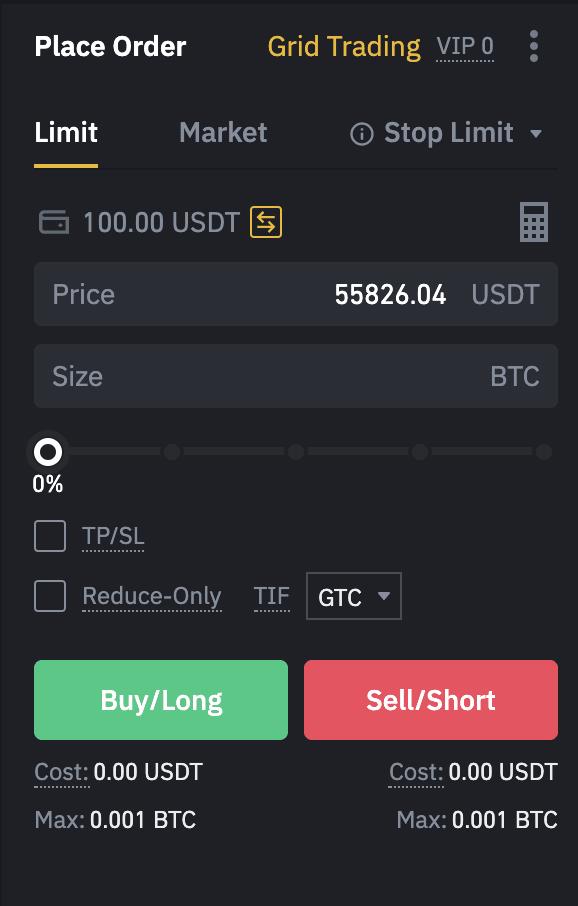

First, launch your grid trading panel by clicking on the Grid Trading tab located on the top right corner of the Binance Futures trading interface.

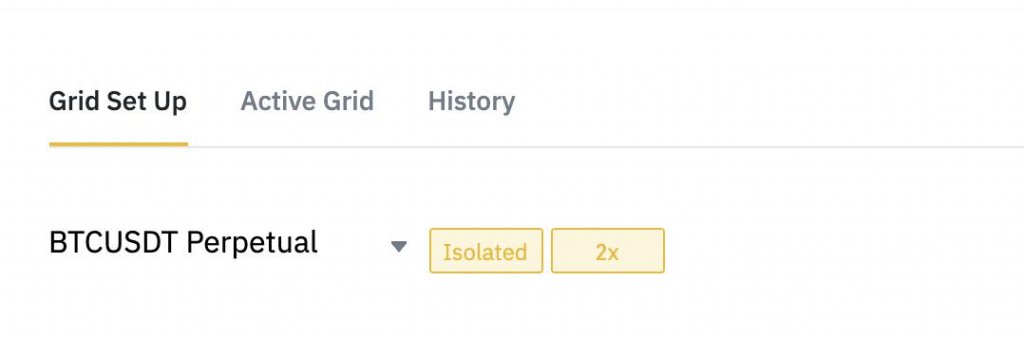

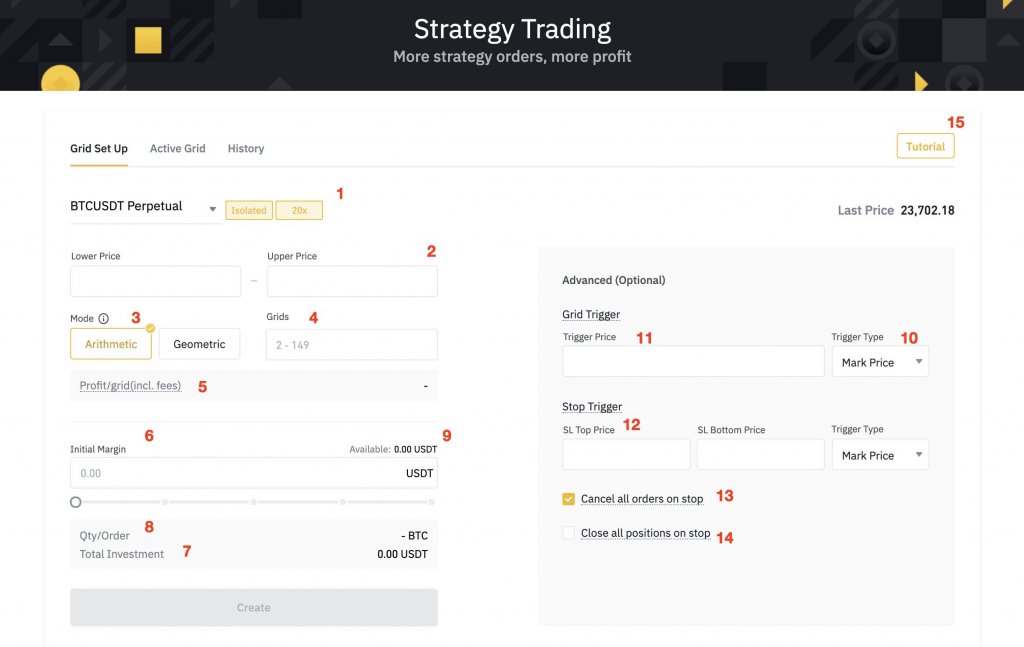

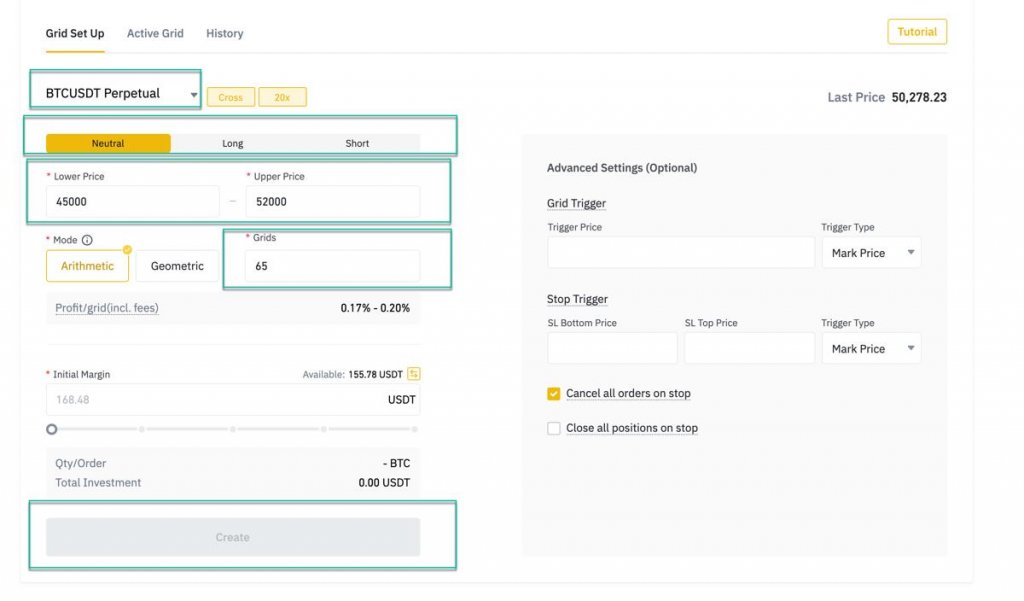

What comes next is determining the type of margin for the grid trading position: Cross or Isolated margin mode. In the Cross Margin mode, the margin is shared between all trading pairs in the Futures account. Meanwhile, in the Isolated Margin mode, the margin is independent in each trading pair.

Afterwards, select your desired leverage amount. The leverage magnifies both profits and losses. With leverage, you can even magnify the smaller price movements to create profits potentially. All this will justify your time and efforts. But, it’s essential to keep in mind that leverage must be used prudently as it is like a double-edged sword

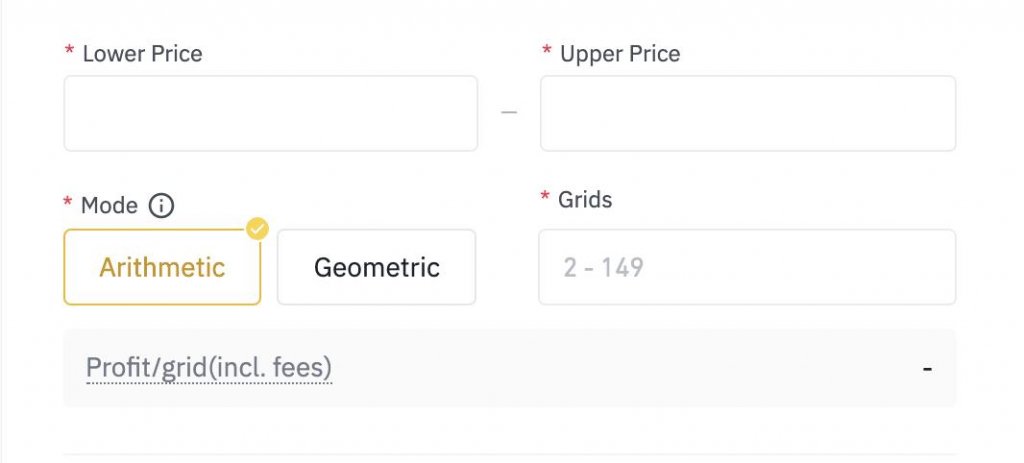

The lower and upper price boundaries are the two most important inputs which one must determine well before launching the Binance Grid Trading Bot. This will verify the range within which your sell or buy limit orders will be placed. In this case, the lowest boundary line will be your last buy-limit order, and on the other side, the highest boundary will be your last sell-limit order.

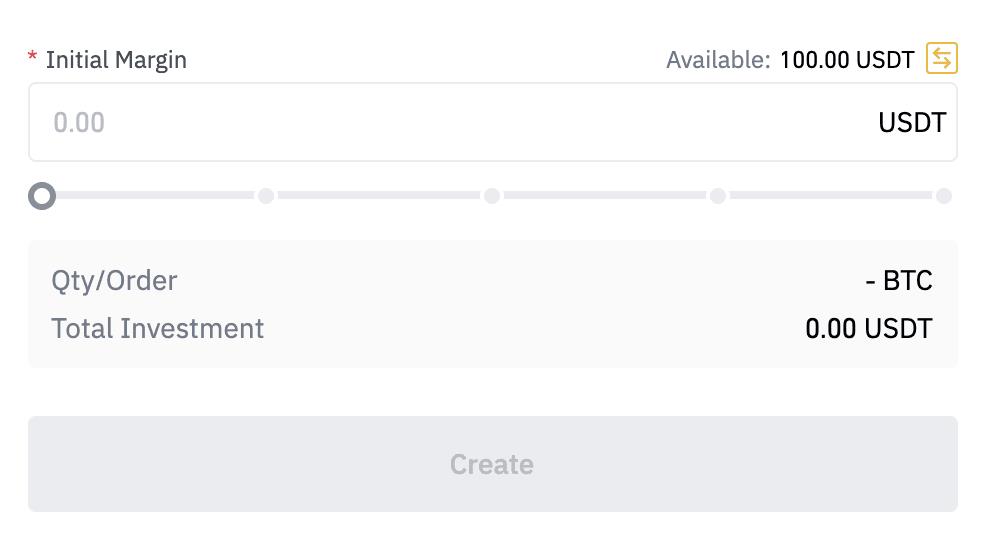

Finally, assign the initial margin of the position. Based on the number of grids, strategy’s price range, and leverage, the system will calculate your initial margin.

Note: The denser the grid is, the greater will be the corresponding initial margin! Make sure that the available balance and the maintenance margin should be higher than the initial margin so as to avoid liquidation.

Growlonix is a platform that allows you to start trading and investing in cryptocurrency seamlessly. Copy trade the best crypto traders with a transparent track record or create a fully automated grid trading bot or other crypto trading bots, or trade yourself using the advanced trading terminal with us for all the connected exchanges.

Grid Trading Bot – Advanced features

The grid trading bot comes with enhanced features and functionality which will enable you to manage your risks and position in a better way. One such feature of the grid trading bot is the trigger price. It is the predetermined price level at which the grid trading bot will be activated.

When the grid trading is triggered, the system will divide the crypto asset price range into several grid levels as per your defined parameters. It also sets the pending orders for each price level. Whenever the crypto asset’s price increases, a buy order is placed immediately at a lower price as soon as the sell order is executed. And, on the other side, the sell order is placed immediately at a high price, if the crypto asset price falls, and a buy order is executed.

This is an amazing strategy that sets you up to buy low and sell high to earn profits in volatile market conditions. Additionally, it also allows you to set a stop-loss for your grid positions. Once your crypto asset’s price crosses below or above your defined stop loss range, your entire grid position will be closed. This will protect you from incurring outsized losses, if the market behaves unfavorably.

If you wish to monitor the trading activity, just click on the Active grid tab to find the trading details. Finally, click Terminate to end the grid trading system.

Key benefits of grid trading

The key advantage of grid trading is that it allows you to trade cryptocurrencies with just a little market forecast- in what direction the prices will likely to go in the future. And, that’s why, it is one of the most effective tools for beginners’ as well expert traders. Here are the key reasons you should consider using grid strategy for trading cryptos:

• Reliable: Grid trading has been around for quite some time now, and you know, it is a proven, time-tested, and profitable strategy. There are numerous records of effective traders successfully using it for years. Due to high volatility in the crypto market, the grid trading strategy has proven to be one of the most reliable options.

• Simplicity and ease-of-use: This strategy doesn’t require any kind of complicated market signals or algorithms. So, it’s very easy to understand and you can use it to earn profits. Even, beginners with no experience in the crypto trading market can easily use it all.

• Liquidity: It is an excellent technique /strategy used for market making in a perfect way. It helps provide liquidity and generates a significant amount of trading volume for the investors. In grid trading, you are essentially a liquidity provider to the exchange, and by placing buy or sell limit orders, you are increasing the market liquidity. As a liquidity provider, you will be paying the maker fee which is cheaper than the taker fee. Therefore, it will lower down your overall transaction costs.

• Versatility: As this strategy is solely based on the fundamental idea of trading (i.e. buy low, sell high), it can be used on any market virtually and lets you earn profits successfully. By choosing the number of grids and defining the price range, you can define the frequency and period of the strategy. You can either set it for short-term or long-term.

• Enhance your risk management: The settings which you are choosing for your grid strategy can make a big difference in its success and allows you to influence the risk level more actively.

• Diversification: The traders recommend that you spread your funds and invest them in multiple assets instead of placing all bets on a single card. Therefore, if you keep two exchangeable assets for the long term, you can use grid trading to earn some extra profits from the fluctuations in between them.

Key tips for grid trading

Determining a lower price range on the Grid is the key to ensure profitability. So, you must be extremely selective on the market trends suitable for your grid trading strategy to avoid being on the risky market. Make sure that the proper risk management measures are in place.

Determining a suitable leverage ratio is a must and you should set appropriate stop-loss and take-profit orders to avoid losses due to the fluctuating market conditions. Make sure that your grid trading parameters are compatible with the current market conditions. The grid trading parameters can be adjusted in real-time according to the present market settings.

Grid trading is ideal for everyone who wants to trade cryptocurrencies systematically. Explore it today at Growlonix!

Those who are in scalp trading may take advantage of grid trading bots to automate their grid strategy. Below, we have compiled a list of the best available grid automatic bots, with my reviews. Some of them are free while some are paid. Try one or two at a time, and see which one will fit your trading style.

Here we go…

Best Crypto Grid trading bots

- Binance trading bots

We all know that Binance is one of the world’s biggest crypto exchange platforms that have an in-built grid bot. A lot of Binance users may not be aware of it, and if you are the one looking for the best grid bot to earn profits on the grid strategy, try Binance trading bot.

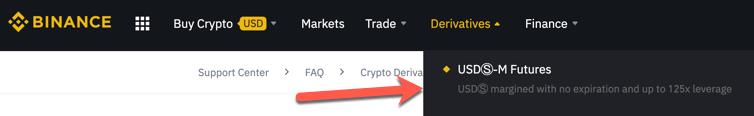

To use this, you need to open a Binance Futures account first as this bot is available only on the Futures account. You may use Growlonix for the Binance spot account grid bot. Once your Futures account is ready, click on Derivatives> USD(S)-M Futures

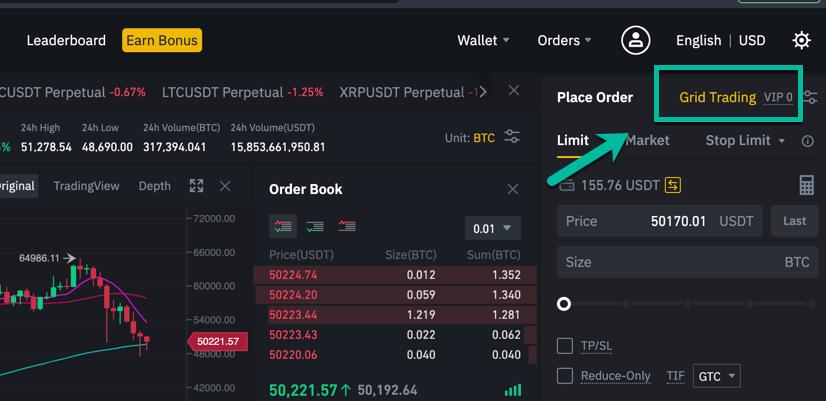

Now, it’s time to click on the Grid Trading tab which is nicely placed in the right corner of your trading page on the Binance app. Make sure to select the right pair, and then transfer USDT to your Futures wallet.

Here, you will see the settings which you need to configure to start setting up the Binance grid trading bot. Click on the create icon to start your first bot. you may click on the Active Grid tab anytime to see the results of the current running grid bot set by you.

We recommend you to start with smaller amounts and make sure to use less leverage when testing. This way, you can minimize the risks of losing funds. This trading bot works great for beginners.

- Bit Universe

This is the first company that has introduced grid trading bots to the cryptocurrency space. The team collaborated with the world’s largest exchanges to align their grid trading bots. It offers many advanced features that no other tool offers including:

• Stop-loss

• Manual grid setting

• AI strategy to auto set the grid

• Leveraged grid bot

• Margin grid bot

Getting started with this trading bot is quite easier, and it works with all popular exchanges in the market.

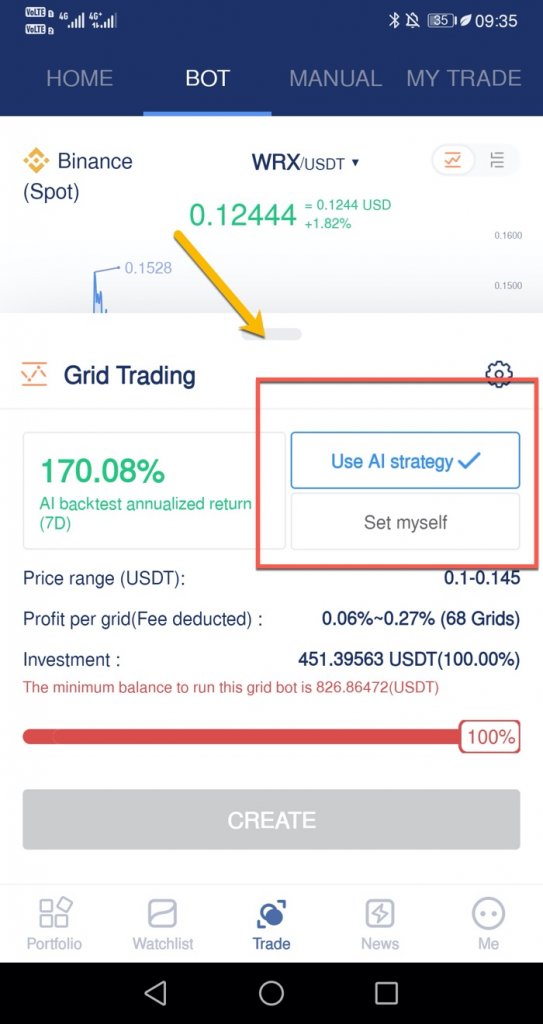

For those looking for a free trading bot, the BitUniverse grid bot is the best available option. To configure it, you can follow the below steps:

• Choose a coin for use with grid trading bot

• Change the parameters either manually or with AI advisor’s assistance

• Build your first grid trading bot and earn profits

There is no membership fee with this trading bot.

- 3Commas Grid bot

This is one of the best Grid trading bots which works with all the popular crypto exchanges. This bot offers AI-based grid trading where you will let the AI to decide the upper and lower limit of the grid. It also offers a manual trading option where you can set a manual upper and lower limit for the grid size.

It supports all the major exchanges but you need to pay a subscription fee for using 3Commas grid trading bot. However, you will get a 3-days free trial, which is good enough for the novices to test out the system. Either way, as per our opinion, 3Commas is a solid option for a majority of experienced and intermediate traders.

- Bitsgap Grid trading bot

This is the latest entrant in the world of the grid trading software market that is nicely done. Bitsgap offers a test account that is ideal for novice traders and allows them to connect with all the popular exchanges including Binance.

There are three different types of bots available on Bitsgap with some nice features like auto-adjust grid size. To run this bot, you need a paid account. They allow you to set grid quantity, price, exchange, lower and upper price limit, and more. There are some additional features available on this platform including Take Profit, Stop Loss, and Trailing Up.

The grid quantity can be anything between 4 and 91, and this trading bot recommends adjusting the profit per grid between 0.5 to 2%. The minimum investment which is required to launch a Bitsgap trading bot depends on the parameters you set.

- Quadency

This is one of the most popular crypto trading bots which offers a grid trading bot as a free feature. In this bot, you can’t set the upper and lower limit manually. But, it gives you full control of what to do if the exit price is reached. Some of the available options are:

• Recreate grid around exit price and continue trading- Use this option if you have enough balance in quote and base to recreate the grid at the point when the price exits the grid.

• Cancel all orders and stop bot: You can use this option if you want to Cancel all the remaining open orders and then stop the bot. this option doesn’t close any open positions and a position is open if it satisfies any of these conditions i.e. bot has bought the quantity but has not sold the same amount, and the bot has sold out but the amount is not bought back.

• Cancel all orders, close all the positions, and stop the bot: This option closes all the positions and cancels all the remaining open orders.

• Do nothing: If all the orders are filled, this option allows the bot to stop working. After the price enters the grid, it will resume trading. And, if the price never enters the grid, all the orders will remain open until you cancel them all manually.

- KuCoin

It is a well-known exchange that offers a diverse range of altcoins. It includes a grid trading bot that employs a classic grid trading approach. This grid trading is a subset of quantitative trading in which multiple grids are set at various values to wait for the market triggers.

This bot supports an extensive catalog of altcoins with easy-to-understand analytics. A minimum of 0.1% fee is charged on this platform for exchanges and the enhanced security makes it a perfect grid trading bot platform for capital investments.

Conclusion

Grid trading bots allow you to automate your trading strategies and minimize your manual work. They operate 24 x 7, and you can customize them as per your requirements. After comparing the above grid trading bots, the Binance trading bot outperforms! The above explains the usefulness of the grid trading bots that can be applied to multiple cryptocurrencies. These bots simplify the trading process since the traders need not to do the market analysis when the system allows you to do the same thing more efficiently.