Table of Contents

Definition:

The bid price represents the highest priced buy order that’s currently available in the market. The ask price is the lowest priced sell order that’s currently available or the lowest price that someone is willing to sell at. The last price represents the price at which the last trade occurred. The spread is the difference in price between the bid and ask prices.

BID price follow

The price will be determined by the first order in the BIDs order book.

Example using Take Profit

- You buy 1 ETH at $100 and set Take Profit of +5%, at $105.

- After a while, ETH begins to rise and the following occurs in the trades:

Example using Stop Loss

- You buy 1 ETH at $100 and set Stop Loss of -5%, at $95.

- After a while, the ETH begins to fall and the following occurs in the trades:

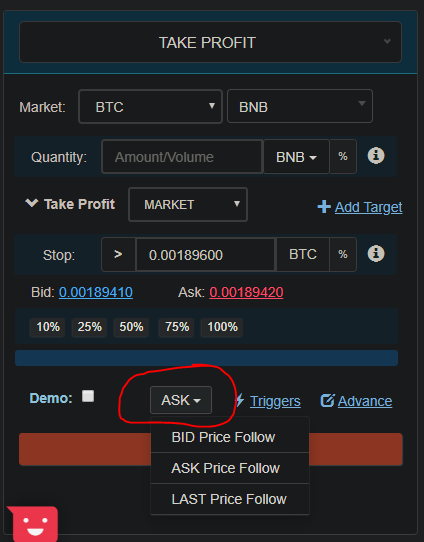

ASK price follow

The price will be determined by the first order in the ASKs order book.

Example using Take Profit

- You buy 1 ETH at $100 and set Take Profit of +5%, at $105.

- After a while, ETH begins to increase, and the following occurs in the trades:

Example using Stop Loss

- You buy 1 ETH at $100 and set Stop Loss of -5%, at $95.

- After a while, ETH begins to drop, and the following occurs in the trades:

Last Price Follow

The last price is the price on which most charts are based. The chart updates with each change of the last price. It’s possible to base a chart on the bid or ask price as well, however. You can change your chart settings accordingly.

Think in terms of the sale of any other asset. You’ve decided to sell your home and you list it at $350,000. You receive an offer of $325,000. After much negotiation, the sale finally goes through at $335,000. The last price is the result of the transaction— not necessarily what you hoped to get, nor what the buyer hoped to pay.

The last price is the most recent transaction, but it doesn’t always accurately represent the price you would get if you were to buy or sell right now. The last price might have taken place at the bid or ask, or the bid or ask price might have changed as a result of or since the last price.

The current bid and ask prices more accurately reflect what price you can get in the marketplace at that moment, while the last price shows at what price orders have filled in the past.

Why Stops doesn’t Trigger sometimes?

If the order didn’t trigger at all, it happens when the price doesn’t reach the trigger level. When you use a conditional order, it doesn’t go to the exchange order book beforehand. We follow the price and places the order when the price reaches the trigger level. We use BID, ASK and Last prices. Above you can find an example of how the BID price is different from the LAST price on the rise.

For conditional orders placed above the actual price, Lets assume user selects Bid price. It’s the price of the first order on the buy order book. When the price reaches $50 on a spike, the first BID order might still be at $47. The price might go up even to $50, and there’s still no buy orders at $50.

For example, let’s say there is a BID order at $40. Someone buys everything up to $50 with a market order, but no one places a buy limit order higher than $40. In this case, even the price on the chart is $50, and the BID price is still at $40.

Similar happens on the price drops.

Note: Apart from Bid/Ask spread there are other reasons for stops not getting triggered. Server Latency (0 to 4 Secs) for most exchanges and up to 10Secs for some exchanges.